Schedule C, Profit or Loss From Business (Sole Proprietorship)

Use Schedule C, to report profit and loss from a business. You may also use the form to report wages and expenses you incurred as a statutory employee or income and deductions of certain qualified joint ventures. Certain amounts shown on a Form 1099, such as a 1099-MISC or 1099-NEC, may also be reported on Schedule C.

Who Uses Schedule C?

Schedule C is used by sole proprietors and single-member limited liability corporations. Do not use this form if you are a C corporation or an S corporation. If you hold down a regular job but freelance on the side, you may be required to complete Schedule C, as well.

How to Complete Schedule C

If you don’t have a high-end tax software program, you should probably enlist the help of a tax professional when completing Schedule C. Before you dive in, however, be sure to have the following items on hand:

- Income statement for the tax year

- Balance sheet

- Receipts/invoices for your business expenses

- Inventory records and valuation (if applicable)

- Vehicle expenses and mileage logs (if used for your business)

There are five (5) sections to Schedule C, not including the top information section (labeled A-J). The following is a brief overview of each section.

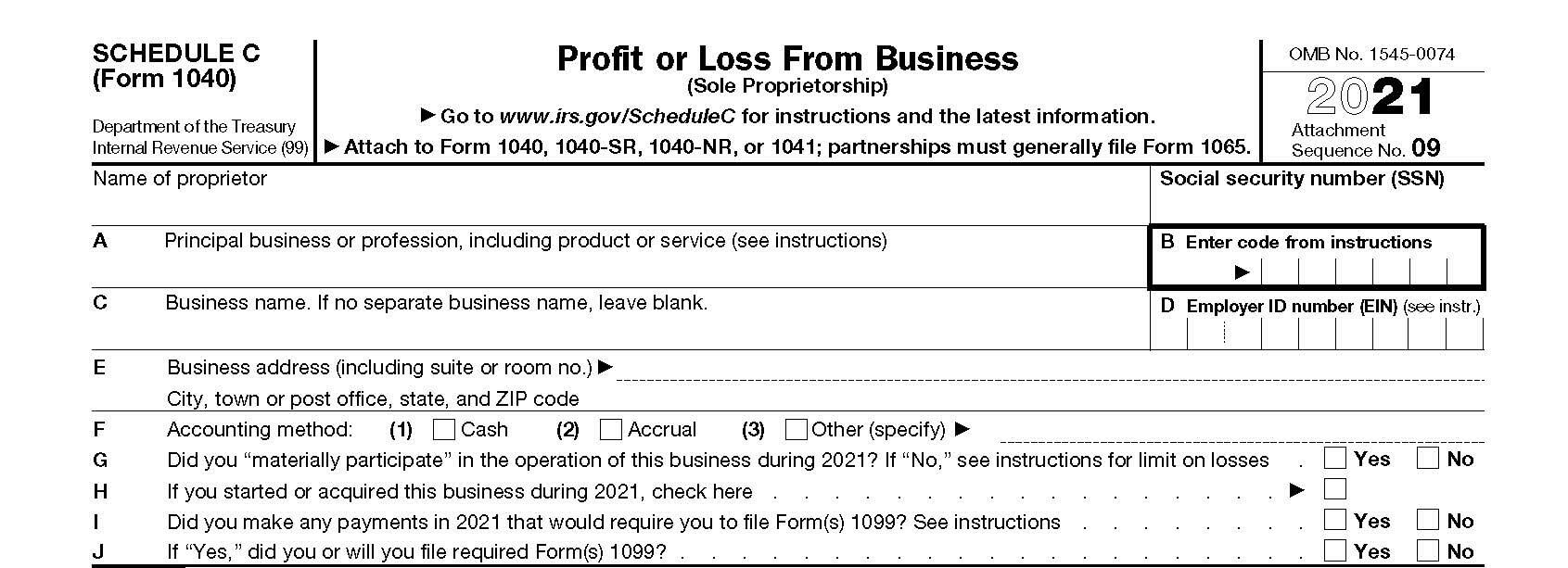

Items A Through J

Make sure you include your name and Social Security number (SSN) at the top of this section. The remainder of this section is fairly self-explanatory, but you will need to refer to the “Principal Business or Professional Activity Codes” at the end of the instruction booklet for Schedule C to obtain the correct code for line B.

For line G, you have “materially participated” in the business if you perform at least 500 hours of service per year, or you perform the majority of the services for the business. If you’re unsure how to answer, be sure to check out the tests on pages 4 and 5 of the instructions.

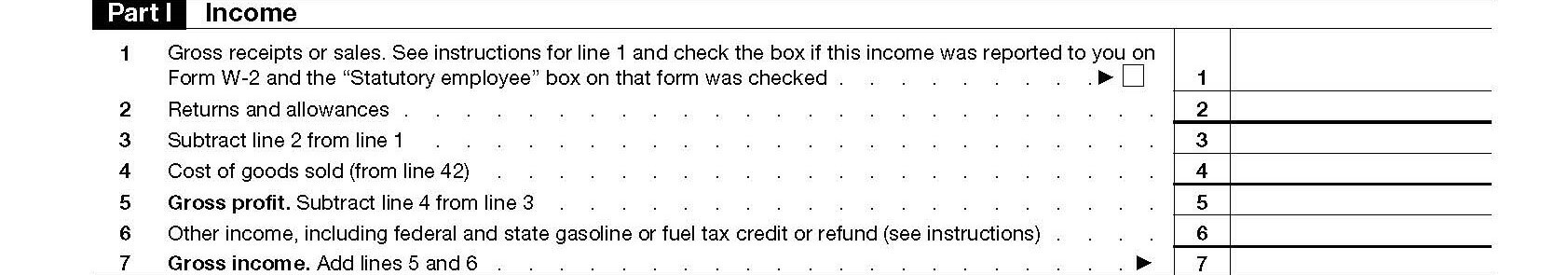

Part I – Income

The purpose of Part 1 is to calculate your gross profit and gross income. You’ll also need to report the total amount you earned from sales and services sold to your clients. You’ll need your Profit and Loss Statement (P & L) for this section, so have it handy.

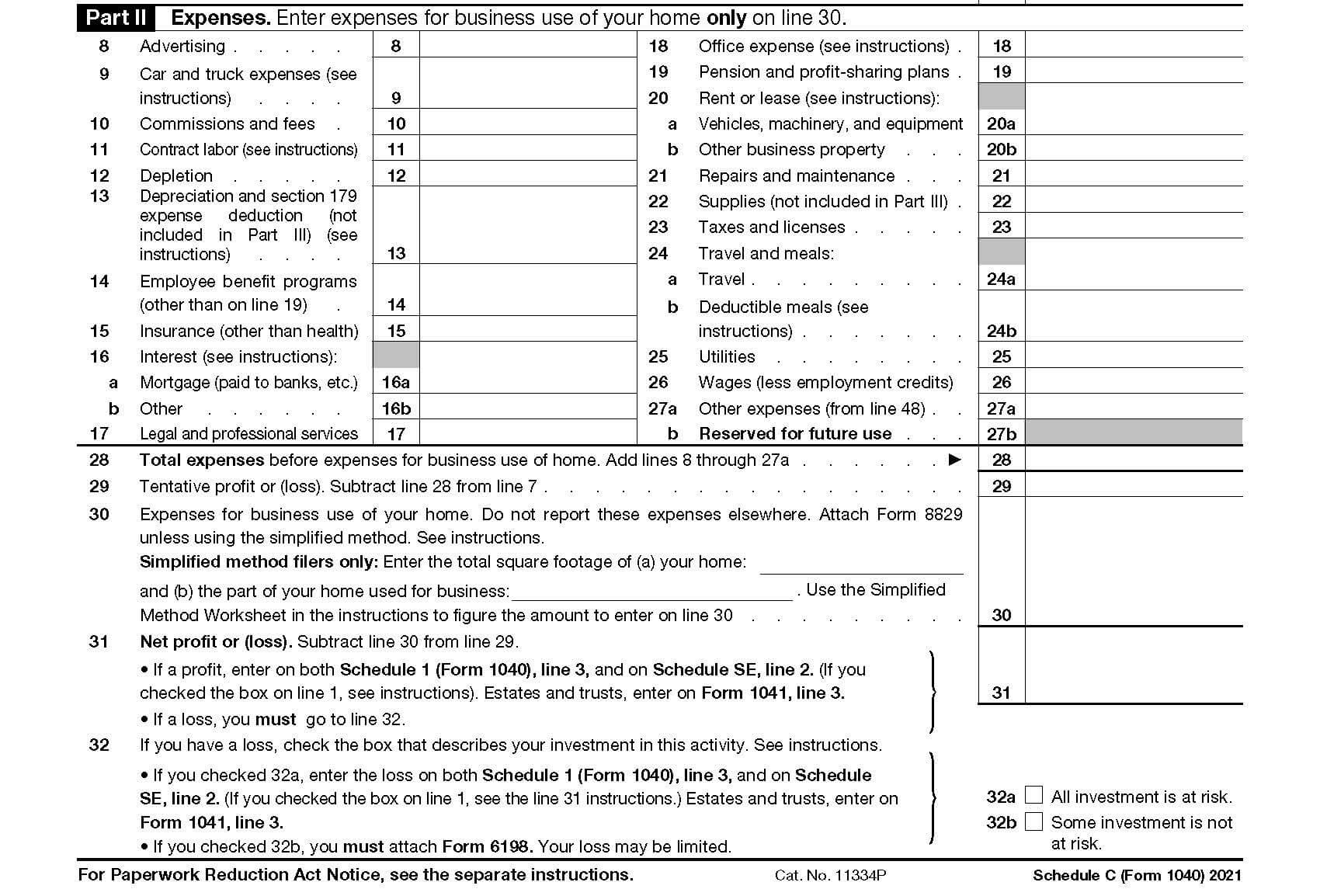

Part II – Expenses

Line 8 through 27 should not include any expenses incurred for the business use of your home. Those expenses should only be reported on line 30. If your company deals with natural resources (gas, mining, timber, etc.), you’ll need to report any depletion on line 12, otherwise, enter zero. For line 27a, you’ll need to complete Part V of Schedule C to calculate the amount.

Line 31 will determine if your business has a net profit or loss for the year. If you had a profit, report the amount on Form 1040, line 12, and Schedule SE, line 2. Estates and trusts should enter the amount on Form 1041, line 3. For losses, you’ll also need to check the appropriate box on line 32a or 32b.

If you check 32a, you’ll need to report the loss on the same schedules and lines as directed above for profits. For box 32b, you must attach Form 6198 and your loss may be limited.

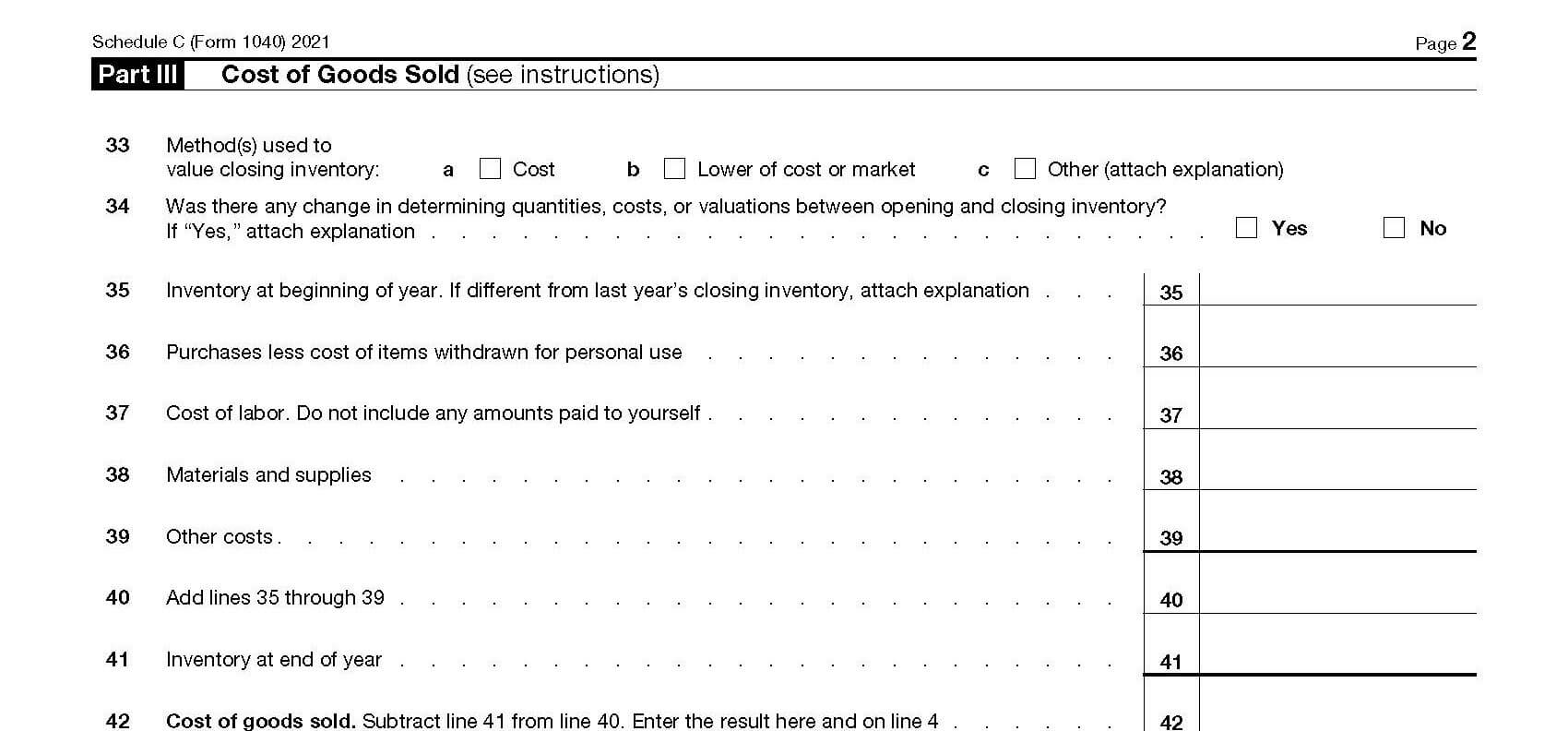

Part III – Cost of Goods Sold

If you sell goods or merchandise or use subcontractors to generate income, you’ll need to complete this section. Do not include any items from Part II in these calculations. Line 42 must also match the amount reported in Part I, line 4.

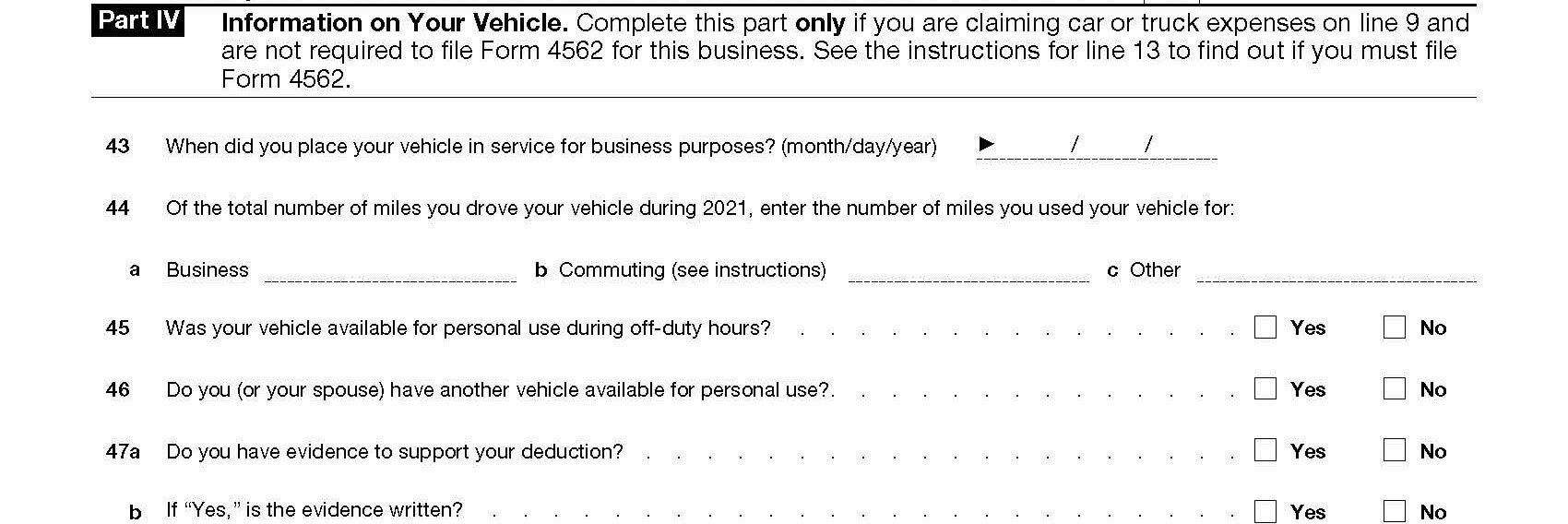

Part IV – Information on Your Vehicle

If you are claiming expenses on line 9 (Part II), but no depreciation, you should complete Part IV of Schedule C instead of Form 4562. If you have no expense on line 9, you can skip this section.

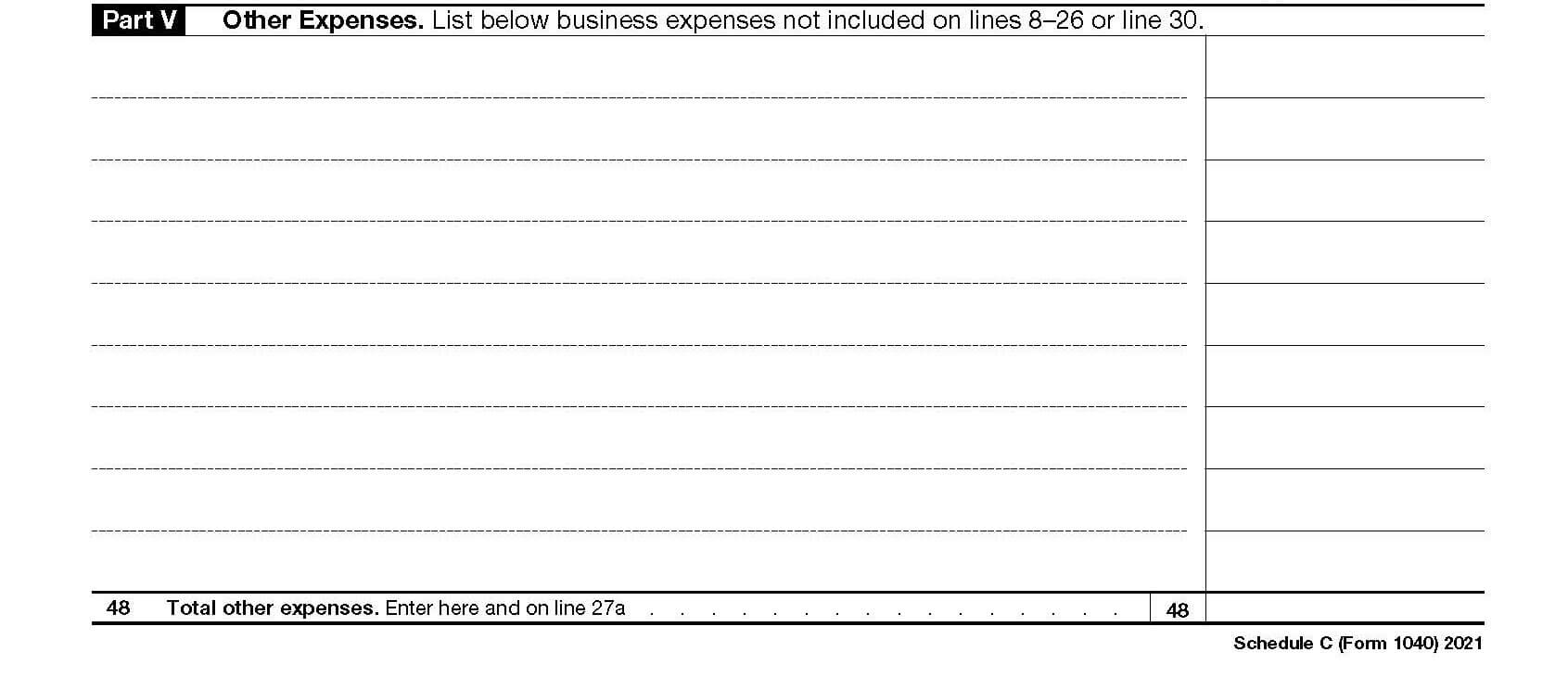

Part V – Other Expenses

Use this section to list any expenses that are not included in Part II, lines 8 through 26, or line 30. The number entered should match the amount on line 27a (Part II).

To learn more about any of the sections, download the full instructions from IRS.gov.

Need Help?

As you can see, Schedule C requires quite a bit of accounting knowledge and relies on good record keeping to ensure accurate reporting of your business income and expenses. Don’t risk making an error and dealing with an IRS audit. Contact Tax Defense Network at 855-476-6920 and schedule a free consultation today!