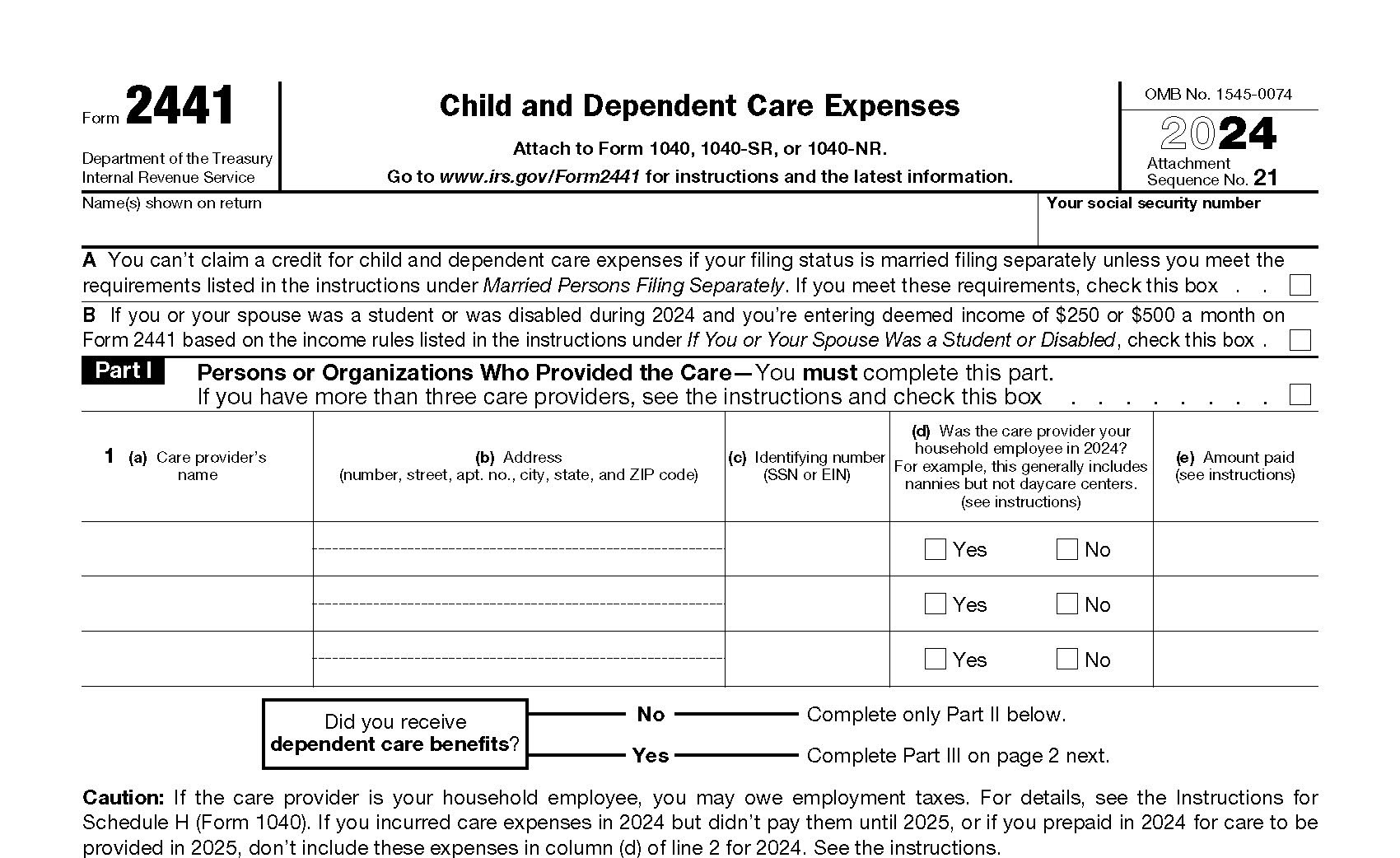

Form 2441, Child and Dependent Care Expenses

IRS Form 2441 is used to report child and dependent care expenses on a federal income tax return. The form helps taxpayers calculate the amount they may be qualified to claim as a tax credit.

Who Should Use Form 2441?

If you paid someone to care for your child or other qualifying person while you worked or looked for work, you may be able to claim a credit for child and dependent care expenses. Additionally, you must use IRS Form 2441 if you (or your spouse if filing jointly) received any dependent care benefits and wish to exclude them from your income.

Generally, you can use Form 2441 if you have earned income and all of the following are true:

- Your filing status is either single, head of household, qualifying surviving spouse, or married filing jointly. You may be able to use the form if you are married and filing separately and meet certain conditions.

- The care provided allowed you to work or look for employment.

- The care was for one or more qualifying persons.

- The person providing the care was not your spouse, your dependent, or the parent of the qualifying child.

- You can include the required information about the provider (name, address, Social Security number (SSN), and fee paid) on the form.

If you (or your spouse if filing jointly) were disabled or a full-time student, you may also qualify for the credit even if you did not have any earned income. Please refer to the instructions for Form 2441 to learn more about the exceptions, which expenses qualify, and who is considered a qualifying person.

How to Complete IRS Form 2441

Form 2441 consists of three parts and spans two pages. At the top of the form, you must write your name (and your spouse if filing jointly) as it appears on your tax return. You must also include your SSN. Be sure to check Box A if you’re filing status is married filing separately and you meet the requirements listed to take the credit. If you (or your spouse) are a full-time student or disabled and plan to enter the deemed income of $250 or $500 per month, you’ll need to check Box B.

Part I

In Part I, you’ll need to provide the required information for any person or organization that cared for your child or qualifying person. This includes their name, address, SSN or Employer’s Identification Number (EIN), and the amount you paid. If the care provider was a household employee, you’ll need to check “yes” in section d. Otherwise, select “no” in that area.

Those who received dependent care benefits must complete Part III before moving on to the next section. Dependent care benefits may include any amounts paid by an employer either directly to your care provider or to you. It may also include the fair market value of a daycare facility sponsored by your employer, or pre-tax contributions you made under a dependent care flexible spending account (FSA).

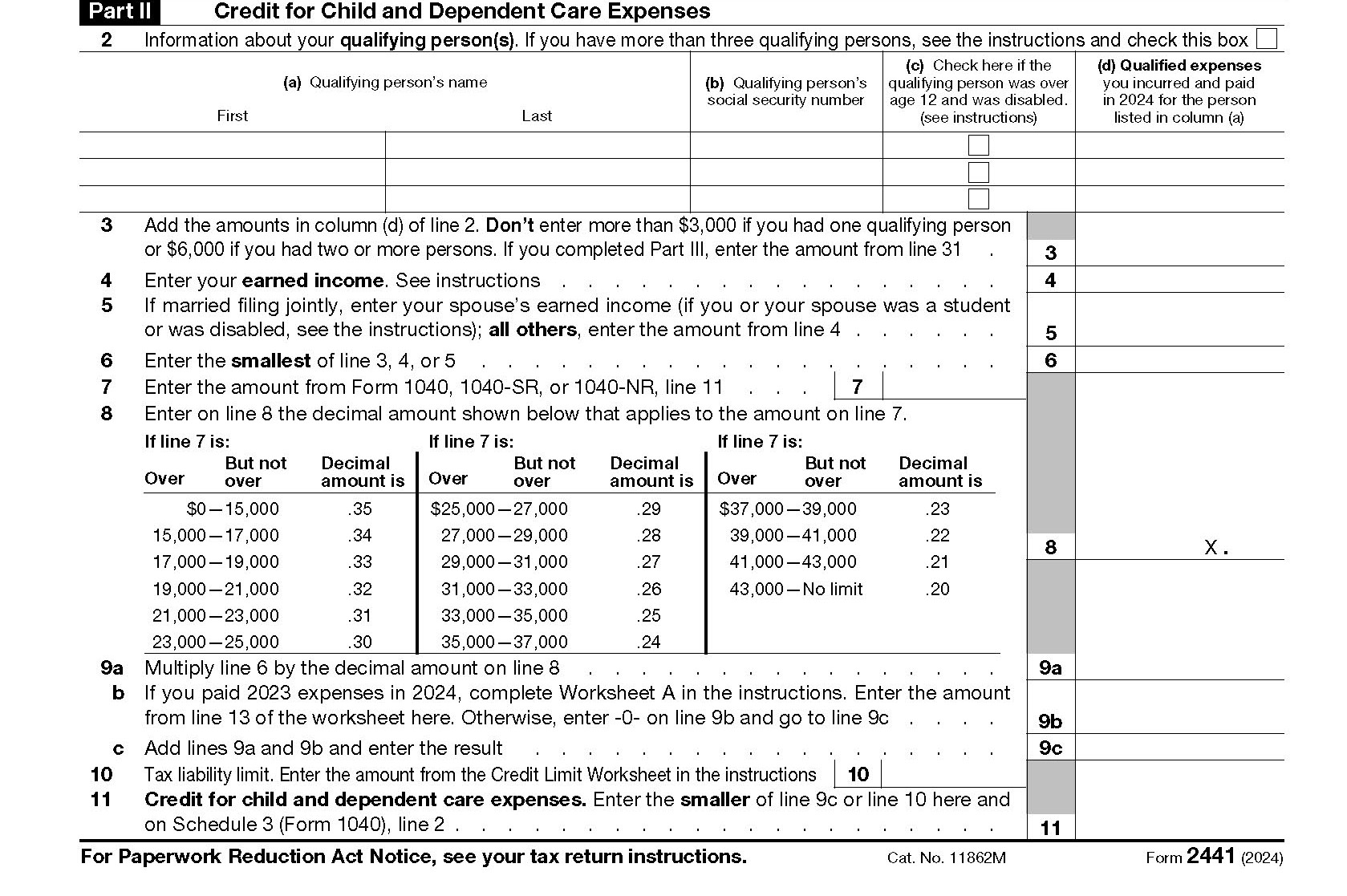

Part II

For Part II, you will need to provide the names, SSNs, and expense amounts for all qualifying persons you are claiming for the tax credit. If you have more than three, please check the box on line 2 and attach a statement to your return with the required information. Be sure to include the three people with the highest qualifying expenses on line 2 of Form 2441.

Line 3 – Add all qualifying expenses and put the total here. Do not enter more than $3,000 for one qualifying person or $6,000 if you have two or more. For those who complete Part III, enter the amount from line 31 here.

Line 4 & 5 – Enter your earned income on line 4. If you are married and filing jointly, you’ll enter your spouse’s income on line 5. Earned income when figuring the credit generally includes the amount shown on Form 1040 line 1z, minus any amount excluded as foreign earned income (Form 2555, line 43), church income reported on Schedule SE (Form 1040), and the amount shown on Schedule SE, line 3, minus any deduction you claim on Schedule 1 (Form 1040), line 15. Child support payments received by you should not be included in your earned income when figuring this credit.

If you or your spouse were a student or disabled, you may claim $250 per month (or $500 per month if you have two or more qualifying persons). If either of you also worked, enter the higher of the two amounts for those months. If both of you were either students or disabled, only one can use the $250 (or $500 for two or more qualifying persons) as monthly income.

Line 6 – Enter the smallest of either lines 3, 4, or 5.

Line 7 – Enter the amount you have on line 11 of your Form 1040, 1040-SR, or 1040-NR.

Line 8 – Locate the amount from line 7 in the chart provided on Form 2441 and enter the corresponding decimal amount here.

Line 9 – On 9a, enter the total by multiplying line 6 by the decimal on line 8. If you paid any previous tax year expenses during this tax year, you’ll need to complete Worksheet A in the instructions and enter the amount from line 13 on line 9b of Form 2441. Next, add lines 9a and 9b together and enter the total on line 9c.

Line 10 – Add the amounts from Schedule 3 (Form 1040), lines 1 and 6I (Form 8978, line 14) together. Subtract that amount from the amount on line 18 of Form 1040, 1040-SR, or 1040-NR. Enter the total on line 10 of Form 2441. Please note, if the total is zero or less, you can’t take the credit for child and dependent care expenses.

Line 11 – Enter the smaller of line 9C or 10 here. You should also include this total on line 2 of Schedule 3 (Form 1040).

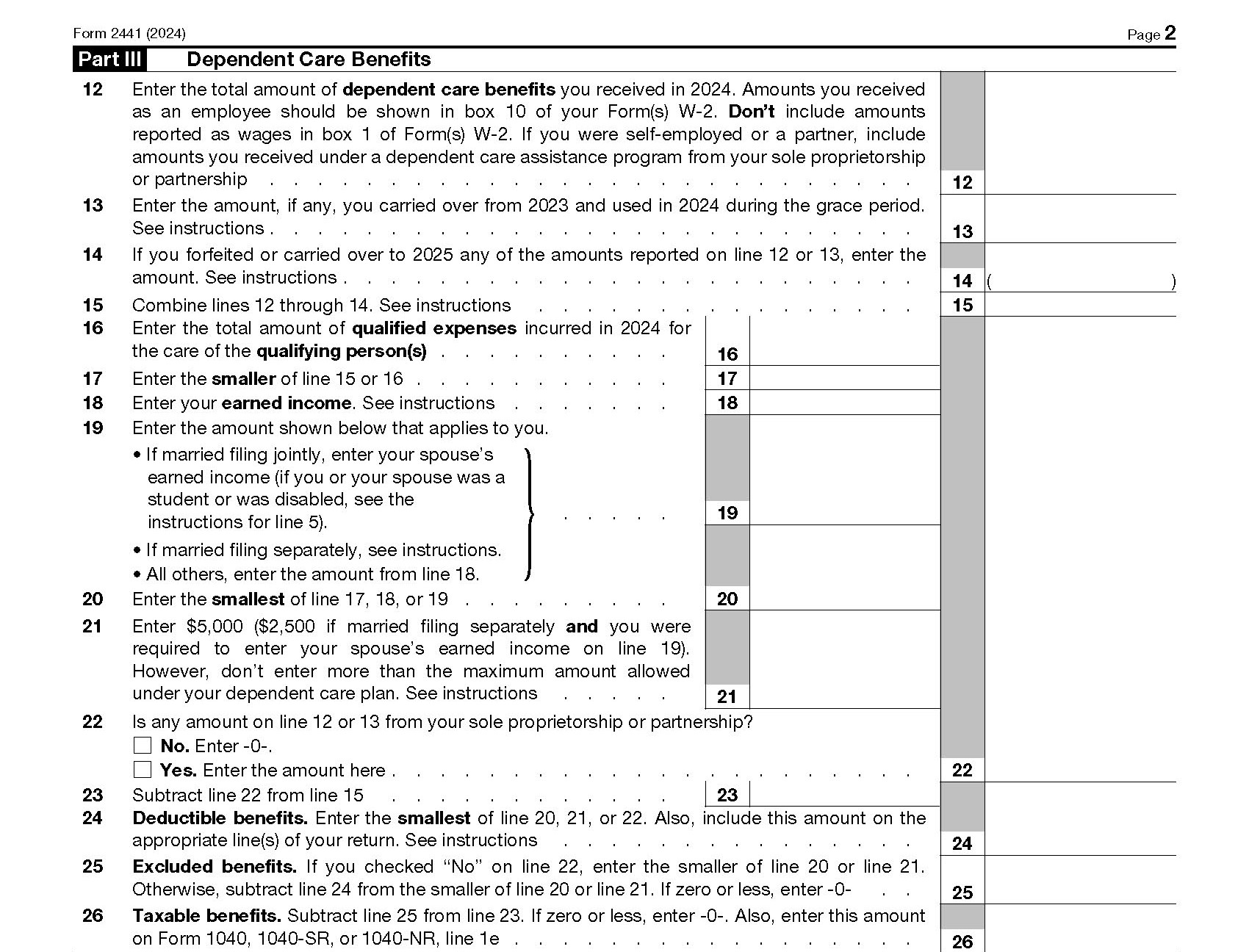

Part III

Do not complete Part III unless you received dependent care benefits during the tax year.

Line 12 – Enter the total dependent care benefits you received for the tax year. This is typically shown in box 10 of your Form W-2. Do not exceed the maximum amount allowed for the filing year.

Line 13 – Include any amount you carried forward from the previous tax year(s) and used during this tax year.

Line 14 – Enter any amounts you forfeited or carried over for the next tax year that were also included on lines 12 or 13.

Line 15 – Add lines 13 and 14. Subtract any amount on line 14 and enter the total here.

Line 16 – Enter the total of all your qualified expenses incurred during the tax year regardless of when they were paid.

Line 17 – Enter the smaller of lines 16 or 15.

Lines 18 & 19 – Enter your earned income on line 18. If you are married and filing jointly, add your spouse’s earned income to line 19. If married filing separately, disabled, or a full-time student, follow the special instructions. Otherwise, enter the number from line 18 on line 19, as well.

Line 20 – Enter the smallest of lines 17, 18, or 19.

Line 21 – Enter the maximum amount you may exclude for the year under your dependent care plan.

Line 22 – Enter “0” if the amount on lines 12 or 13 DO NOT include money from a sole proprietorship or partnership. Check “yes” if they do and enter the amount on line 22.

Line 23 – Subtract line 22 from line 15 and enter the total here.

Line 24 – Enter the smallest of lines 20, 21, or 22 here.

Line 25 – If you checked “no” on line 22, enter the smaller of line 20 or 21. Otherwise, subtract line 24 from line 20 or 21 (whichever is smaller) and enter the total here. If it is zero or less, enter zero.

Line 26 – Subtract line 25 from line 23. If it is zero or less, enter zero here. Otherwise, enter the amount on line 26 and on Form 1040 (or 1040-SR, 1040-NR), line 1e.

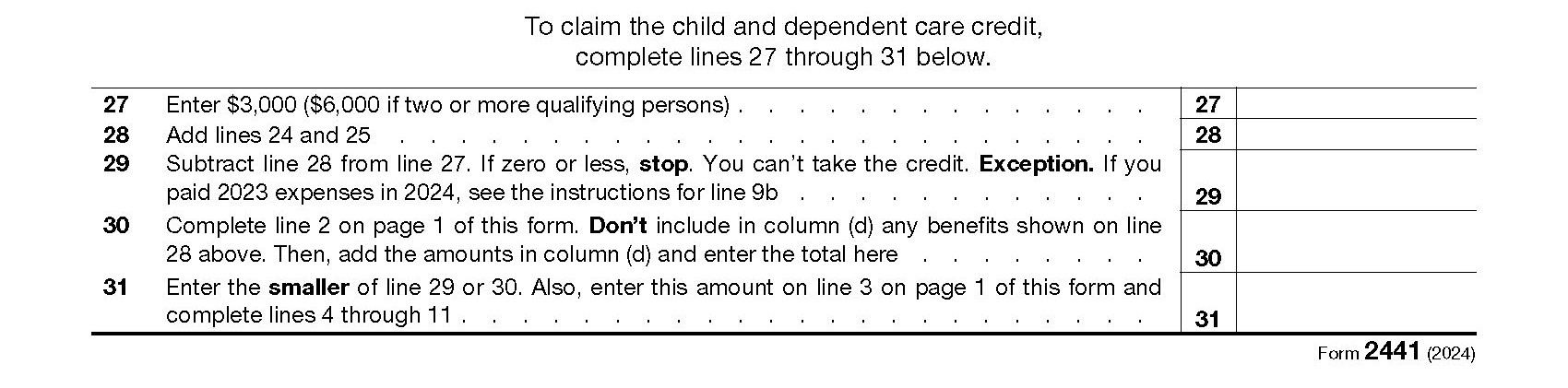

Line 27 through 31 – Follow the math instructions to determine the amount you can claim for the Child and Dependent Care Credit.

Need Help?

If you need assistance with preparing your taxes, including IRS Form 2441, please contact Tax Defense Network at 855-476-6920. We offer an array of affordable tax services for both individuals and small business owners.