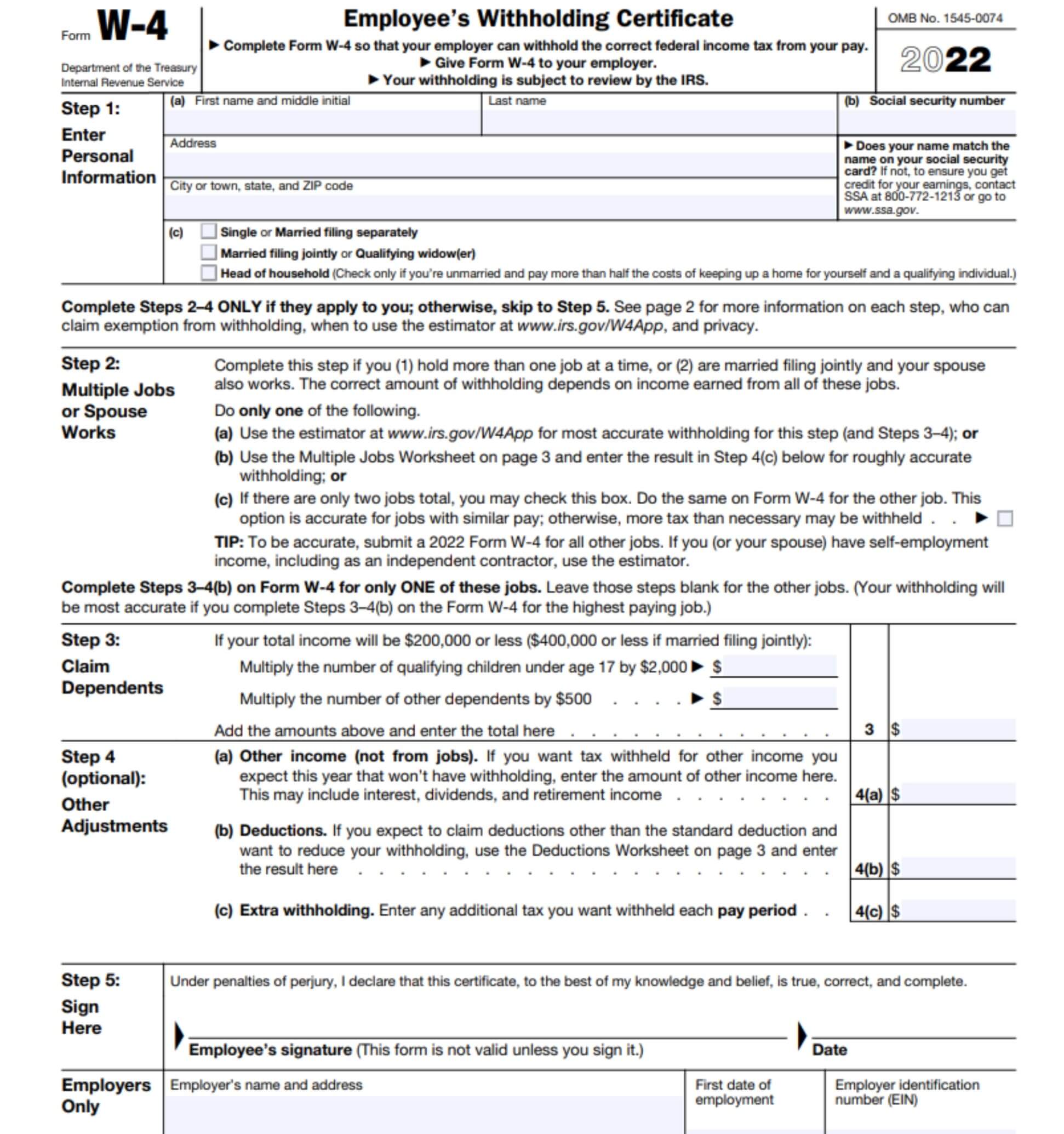

Form W-4, Employee’s Withholding Certificate

The purpose of IRS Form W-4 is to ensure your employer is withholding the correct amount of federal income tax from your pay. If too little is withheld, you could face an unexpected tax bill and may owe a penalty for underpayment. If too much is withheld, you’ll generally receive a refund.

Who Should Complete Form W-4?

Most taxpayers complete Form W-4 when they begin work for a new employer. If your employer neglects to give you a Form W-4 to complete, be sure to ask for one. Failure to complete the form will result in the IRS treating you as a single filer and withholding taxes at the highest amount.

There are other instances when you may need to update or change your form, including:

- The birth or adoption of a new child

- A change in your marital status (recently married or divorced)

- Your financial status has changed

To make changes to your form, simply request a new W-4 from your employer.

How to Complete Form W-4

In 2020, Form W-4 was redesigned to make the form simpler to complete. It no longer includes the “allowances” section which confused many taxpayers. You do not have to complete a new W-4 if you already have one on file with your employer. If you’ve changed jobs or want to adjust your withholding, however, here’s how to complete the new form.

Step 1 – Personal Information

In this section, you should include your legal name (this should match your Social Security card), Social Security number (SSN), and address. Be sure to check your filing status, as well. This will determine the standard deduction and tax rates used to calculate your withholding.

Step 2 – Multiple Jobs or Spouse Works

You are not required to complete this step unless you hold more than one job, or you’re married filing jointly and your spouse also works. Choose only one of the three available options to determine your withholding. Option (a), www.irs.gov/W4App, is the most accurate. For those with only two jobs total (either a single person with two jobs or a married couple where both have only one job each), check the box on option 2(c). If you’re married, be sure that your spouse also checks this box on their form.

Step 3 – Claim Dependents

This section is used to determine your eligibility for the Child Tax Credit and credit for other dependents. If you do not have any qualifying children or other eligible dependents, you are not required to complete this section. You may also skip this section if your income exceeds the stated limits.

Step 4 – Other Adjustments

Step 4 of Form W-4 allows you to adjust your withholding amounts. You may increase withholding by including other income (do not include income from any jobs or self-employment) on Step 4(a) or elect to have more money taken from your paychecks on Step 4(c).

To decrease the withholding amount, include any deductions you expect to take on Step 4(b). Deductions entered here include both itemized and others, such as interest paid on student loans and IRAs. Do not include the standard deduction in this calculation.

Step 5 – Signature

Before returning this form to your employer, be sure to sign and date it.

Form W-4 Example

Need Help?

If you need assistance completing Form W-4, visit the IRS website. For help with other tax matters, contact Tax Defense Network at 855-476-6920. We offer affordable tax relief and tax preparation services.