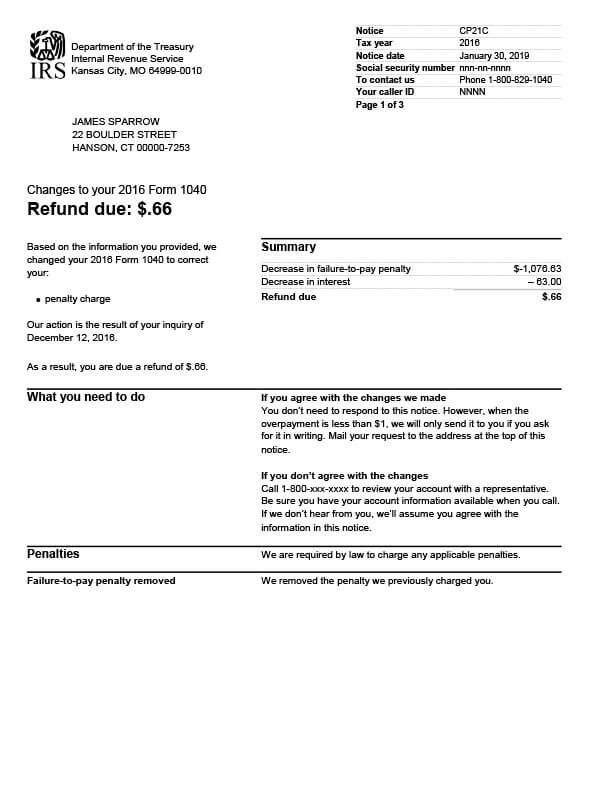

IRS Notice CP21C – Changes to Tax Form

The IRS sends notice CP21C when it makes corrections to Form 1040. Those changes, however, did not result in any refund or balance due.

Why Did I Receive IRS Notice CP21C?

You will typically receive IRS Notice CP21C after you ask the IRS to make changes to your Form 1040 or submit an amended return, and the changes result in a zero tax balance. If you don’t remember asking for any changes to be made, you can always call the number listed on your IRS notice.

Next Steps

Review your CP21C notice carefully to see what was changed on your tax form.

If you agree with the changes:

- No response is required. Simply keep a copy of the tax notice for your records.

If you disagree with the changes:

- Call the IRS at the number listed on your letter and review the changes made with a representative. Have a copy of your tax return and the notice handy before you call.

- You may contact the IRS by mail at the address provided at the top of your CP21C notice. Include your Social Security number (SSN), the tax year, and the form number (1040) in your correspondence.

The IRS will assume you agree with the changes if they do not hear from you. It’s best to contact them as soon as possible if you wish to dispute any changes made to your tax form.

Who Should I Contact if I Have More Questions?

If you need help understanding your notice CP21C, please contact the IRS at the number listed on your letter or call 800-829-1040.