IRS Notice CP39 – Refund Applied to Tax Debt

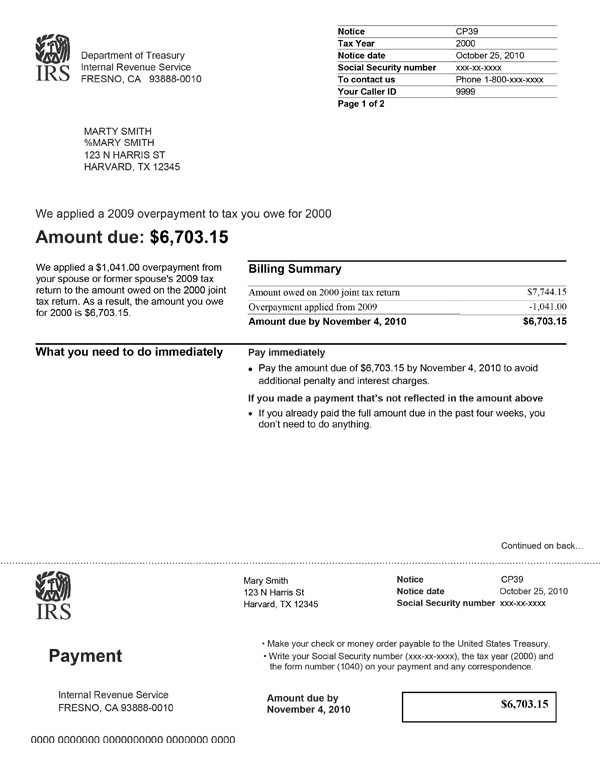

IRS Notice CP39 is sent to a taxpayer when their expected refund is applied to an outstanding tax debt.

Why Did I Receive IRS Notice CP39?

You received IRS Notice CP39 because you were expecting a tax refund. Unfortunately, you owe a federal tax debt from a prior tax year, so the IRS used some or all of your refund to pay your debt. This is known as tax refund offset.

Next Steps

The first thing you should do is read your notice in its entirety. It will explain how your refund was used and how much you may still owe. The IRS will also provide additional information on how to repay any balance due.

If you haven’t filed your taxes and did not expect a refund, contact the IRS immediately. You could be a victim of tax fraud (refer to the Taxpayer Guide to Identity Theft to learn more).

If you disagree with the notice, call the toll-free number on your letter. Be sure to have a copy of your notice, tax return, and any relevant documentation handy. You may also reach out to a tax professional to explore your relief options.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP39, you can contact the IRS at the number provided on your notice. You can also call Tax Defense Network at 855-476-6920 for a free consultation. Depending on your financial situation and filing status, you could be eligible for a payment plan, Offer in Compromise, or even Innocent Spouse Relief.