IRS Notice CP21B – Changes to Form 1040

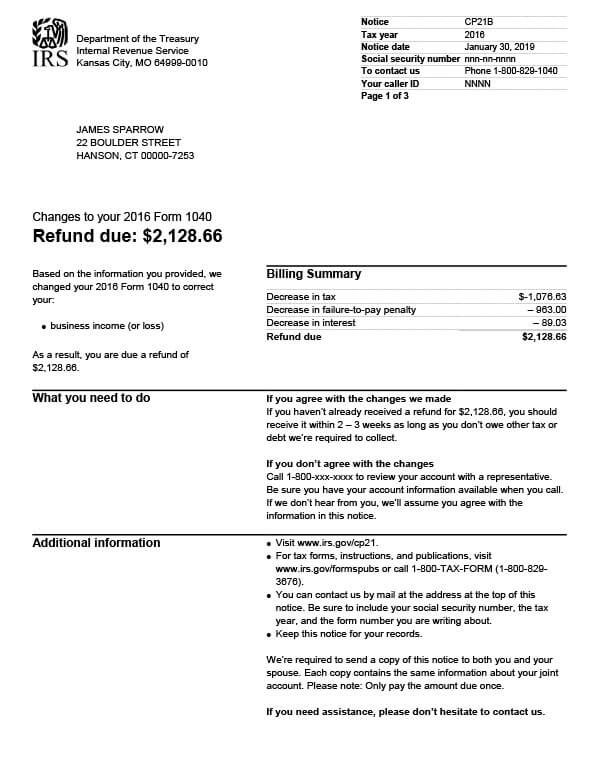

Notice CP21B is sent when the IRS makes changes to Form 1040 based on information provided by the taxpayer. As a result of those changes, there is now a refund due.

Why Did I Receive IRS Notice CP21B?

You received IRS Notice CP21B because you discovered an error on your original tax return and submitted either an amended return or contacted the IRS directly. The IRS made the changes you requested and determined that a refund is now due.

Next Steps

Read IRS Notice CP21B carefully. It will detail the changes made to your tax return and the amount of your tax refund.

If you agree with the changes made:

- Nothing else is required. You should receive your refund within 2-3 weeks. If you have a previous tax balance, however, the IRS may offer part or all of the refund to pay down your tax debt. Call the number listed on your notice if you don’t receive your refund after three weeks.

If you disagree with the changes made:

- Contact the IRS at the number listed on your notice and review your account with a representative. Be sure to have a copy of your tax return and the notice before you call, or

- Contact the IRS by mail. Use the address provided at the top of your CP21B notice. Don’t forget to include your Social Security number, the tax year, and form number (1040) in the letter.

If you do not respond to the tax notice, the IRS will assume you agree with the changes. Always keep a copy of the tax notice for your records.

Who Should I Contact if I Have More Questions?

If you need additional assistance regarding your CP21B notice, please contact the IRS at the number listed on your notice or call 800-829-1040.