IRS Notice LT26 – Unfiled Tax Returns Due Immediately

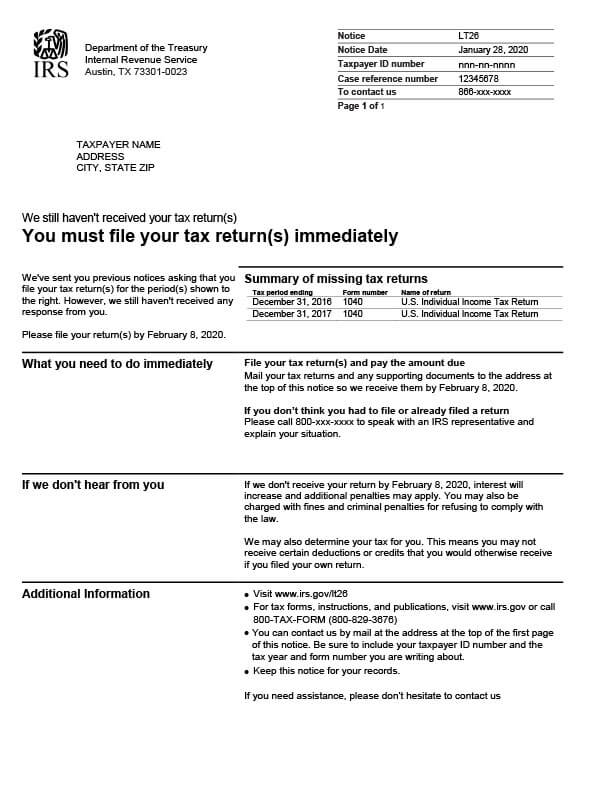

IRS LT26 is sent to a taxpayer when they have failed to respond to previous notices regarding unfiled tax returns.

Why Did I Receive IRS LT26?

You received IRS LT26 because you have one or more unfiled tax returns. The IRS sent several notices regarding the unfiled returns but hasn’t received a reply. LT26 is to warn you that continued non-compliance will lead to increased interest fees and penalties. The IRS may also charge you with fines and criminal penalties if you continue to refuse to comply with the law. A Substitute for Return (SFR) could also be filed to determine your tax for you. If this happens, you may not receive the deductions and tax credits you would otherwise be eligible to receive.

Next Steps

Carefully review your LT26 and keep a copy for your records. It will include a summary of the missing tax returns you must file and instructions on what to do next.

- Send in the missing tax returns and payments to the address on your LT26 within 10 days from the date of your letter.

- If you’ve already filed, call the IRS at the number listed on the letter.

- If you don’t believe you are required to file, call the IRS at the number listed.

Do not wait to file because you can’t pay your taxes in full. Instead, file and pay what you can. In most cases, you will be eligible for a payment plan that will allow you to pay off your balance over time.

Who should I contact if I have more questions?

For questions about your IRS LT26, please contact the IRS at the number listed on your letter. You can also call Tax Defense Network at 855-476-6920 and request a free consultation. We can prepare and submit your unfiled tax returns for you, and see if you’re eligible for tax relief.