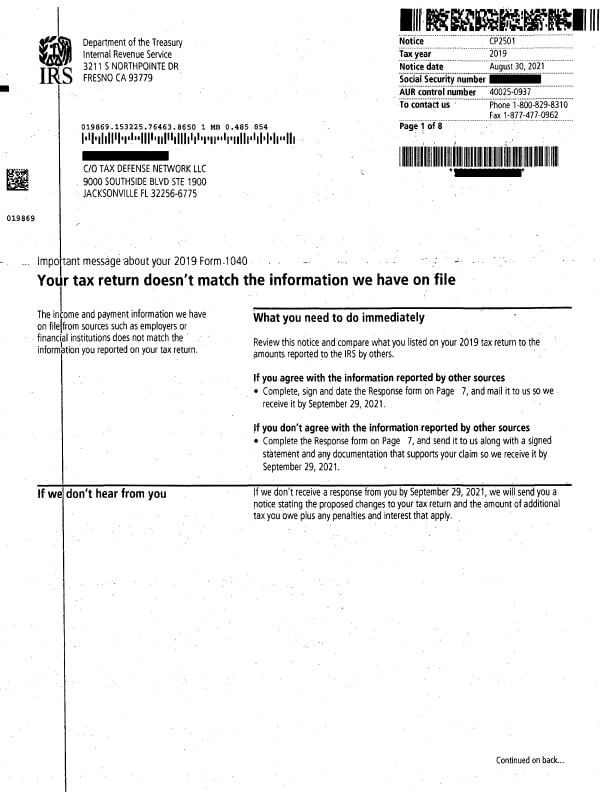

IRS Notice CP2501 – Inaccurate Tax Return

IRS Notice CP2501 is sent to taxpayers when the income reported on their tax returns does not match the information provided to the IRS by other third parties.

Why Did I Receive IRS Notice CP2501?

You received notice CP2501 because the IRS Automated Underreporter (AUR) unit needs additional information regarding a discrepancy in the income you reported. The income information provided by your employer, bank, or another third party does not match the information you provided on your tax return. This discrepancy may increase or decrease the amount you owe, or it may not change at all.

Next Steps

Read your CP2501 notice and save a copy for your records. The notice will explain the information the IRS received, how to respond, and the consequences of ignoring the notice.

If you agree with the information:

- Sign and date the response form. For joint returns, both parties must sign the form.

- Mail or fax the form to the IRS by the deadline date.

The IRS will send a notice of proposed changes and the amount of additional tax you owe. There is no need to file an amended return. If you made similar mistakes on other tax returns, however, file an amended return for any year in which the error occurred. You should also review your state or local tax return as soon as possible.

If you disagree with the proposed changes:

- Sign and date the response form.

- Include a signed statement that explains why you disagree with the information provided.

- Submit any documentation that supports your claim.

- Mail the form, statement, and documentation to the address provided.

Failure to respond to CP2501 will result in the IRS sending a notice about the proposed changes to your return. The notice will also include information about any additional tax you owe plus any penalties and interest that apply.

Who should I contact if I have more questions?

For questions about your IRS Notice CP2501, call the number listed on your notice. You can also call Tax Defense Network at 855-476-6920 for a free consultation. We’ll review your case and explain your tax relief options.