IRS Notice CP92 – State Tax Refund Offset

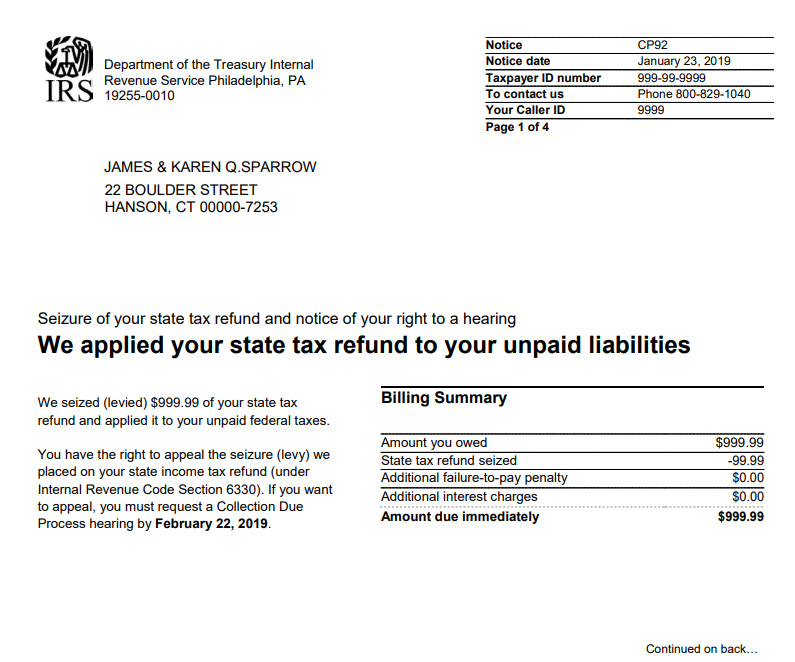

IRS Notice CP92 is sent to a taxpayer when the IRS levies their state tax refund and applies it to their unpaid tax balance.

Why Did I Receive IRS Notice CP92?

You received IRS Notice CP92 because you have an outstanding tax balance. The IRS kept your state tax refund (also known as offset or a refund levy) and applied it to your tax debt.

Next Steps

Read your CP92 notice carefully. It will detail the amount you owe, as well as the amount of your state tax refund seized. If you were assessed any interest or penalty fees, these will also be listed on the notice.

If you agree with the changes:

- No action is required at this time.

If you disagree or wish to appeal:

- Complete and mail Form 12153, Request for a Collection Due Process or Equivalent Hearing, by the deadline date indicated on the notice. Send the form to the address listed at the top of page 1 of your CP92. Be sure to include a copy of your notice with the form.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP92, or can’t pay your remaining balance in full, call the number listed on your notice. You may also schedule a free consultation with one of our tax professionals by calling 855-476-6920. You could be eligible for penalty abatement or other tax relief options.