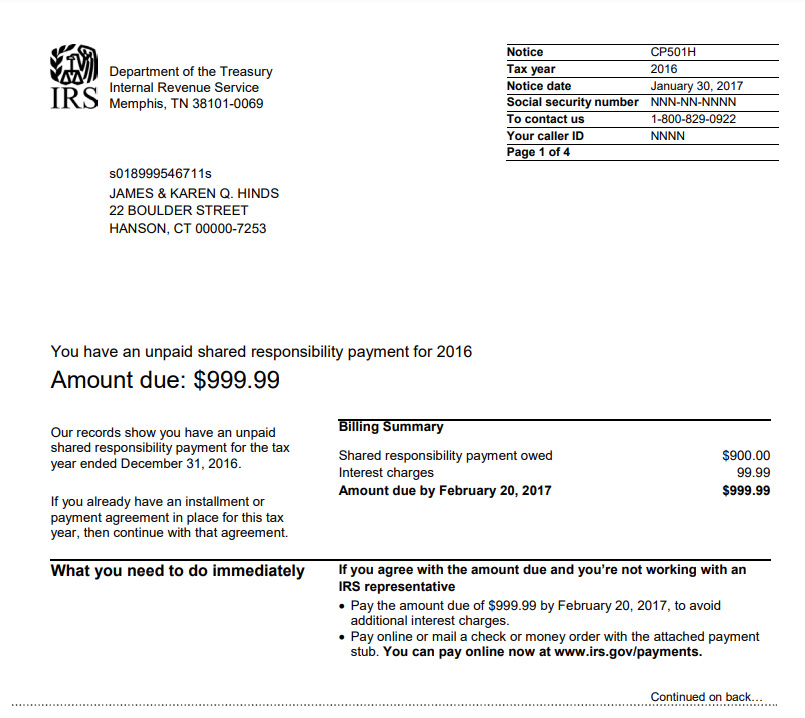

IRS Notice CP501H – Unpaid Shared Responsibility Payment

IRS Notice CP501H is sent to taxpayers who have outstanding shared responsibility payments due from tax year 2018 or earlier.

Why Did I Receive IRS Notice CP501H?

You received IRS Notice CP501H because you did not meet the minimum healthcare coverage required (per IRS Code Section 5000A) for the tax year indicated on your notice. As a result, you now have a balance due.

Next Steps

Read your CP501H notice carefully. It explains the due date, the amount owed (including interest), and your payment options.

If you agree with the amount due:

- Pay the amount owed by the deadline date indicated on the notice. You can pay online or send a check (or money order) with the payment stub included with your notice. Be sure to include your Social Security number (SSN), the tax year, and “SRP” on your payment. Payments should be made to the United States Treasury.

If you disagree with the amount due:

- Call the IRS at 800-829-0922 to review your account with a representative. Have a copy of your notice handy.

If you are unable to pay the amount in full, pay what you can now and explore your payment options. This may include an installment agreement, Offer in Compromise, or Currently Not Collectible (CNC) status.

Who Should I Contact if I Have More Questions?

If you have questions regarding your IRS Notice CP501H, please call 800-829-0922.