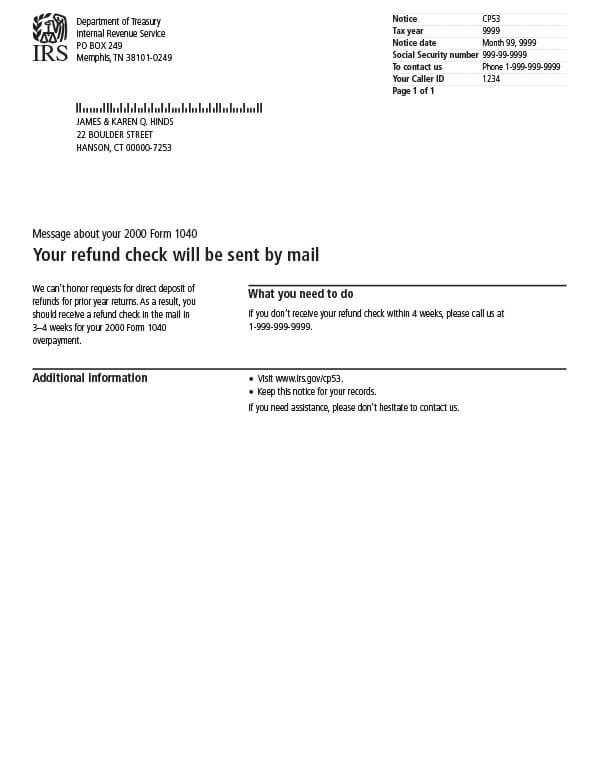

IRS Notice CP53 – Refund Being Sent by Mail

IRS Notice CP53 informs the taxpayer that their refund check is being sent by mail.

Why Did I Receive IRS Notice CP53?

You received notice CP53 because the IRS is unable to deposit your tax refund electronically (direct deposit). Instead, you’ll be receiving your refund check by mail.

Next Steps

Keep a copy of your CP53 notice for your records. If you don’t receive your refund check within three to four weeks, you’ll need to contact the IRS by calling the toll-free number listed on your tax notice.

If you moved and did not update your address with the IRS, your check will be sent back to the IRS. To avoid delays, submit Form 8822, Change of Address, or call the number listed to update your address on file.

Who Should I Contact if I Have More Questions?

If you have questions regarding your IRS Notice CP53, call the number listed on the notice or 800-829-1040.