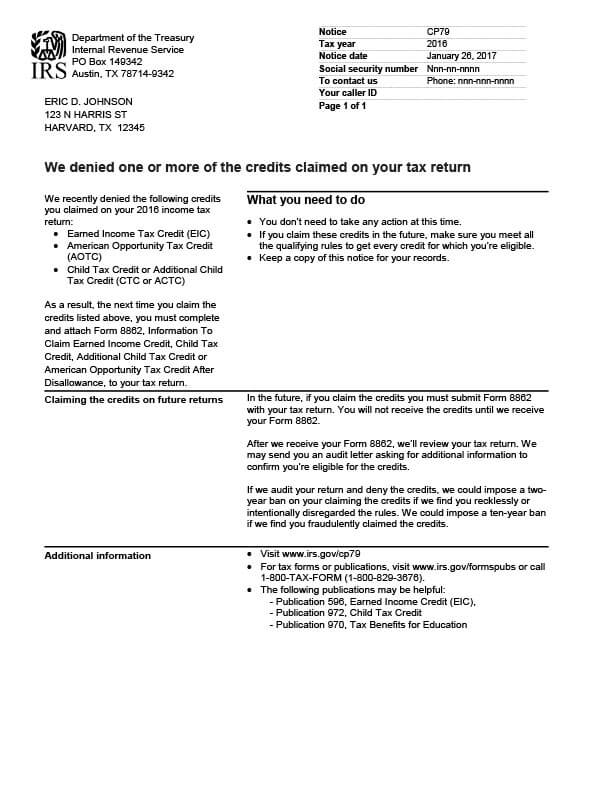

IRS Notice CP79 – Denied Tax Credits

IRS Notice CP79 is sent to taxpayers when the IRS disallows their claim for the Earned Income Tax Credit (EITC), American Opportunities Tax Credit (AOTC), Child Tax Credit (CTC), and/or the Additional Child Tax Credit (ACTC) because they did not meet the eligibility requirements.

Why Did I Receive IRS Notice CP79?

You received a CP79 notice because you claimed the EITC, AOTC, CTC, and/or ACTC on your tax return. The IRS has determined that you are not eligible to receive one or more of these credits. As a result, the next time you claim any of the credits listed on your notice, you must complete Form 8862, Information to Claim Earned Income Credit, Child Tax Credit, Additional Child Tax Credit or American Opportunity Credit, and attach it to your tax return.

Next Steps

No additional steps are required after receiving IRS Notice CP79. Keep a copy of the notice for your records.

If you disagree with the initial audit:

- You may request reconsideration of the audit and provide documentation showing you are entitled to the credit(s) for the audited year.

If you claim any of these credits in the future, submit Form 8862 with your return. The IRS may send you an audit letter and ask for additional information to confirm your eligibility. If the audit results in a denial of the credit(s), the IRS may impose a two-year ban on you claiming the credits if they believe you recklessly or intentionally disregarded the rules. A ten-year ban may be imposed if you fraudulently claimed the credit(s).

Who Should I Contact if I Have More Questions?

For questions about your IRS Notice CP79, call the number listed on your notice or call 800-829-1040. If you’d like assistance with a reconsideration request or would like to explore other tax relief options, call Tax Defense Network at 855-476-6920 for a free consultation.