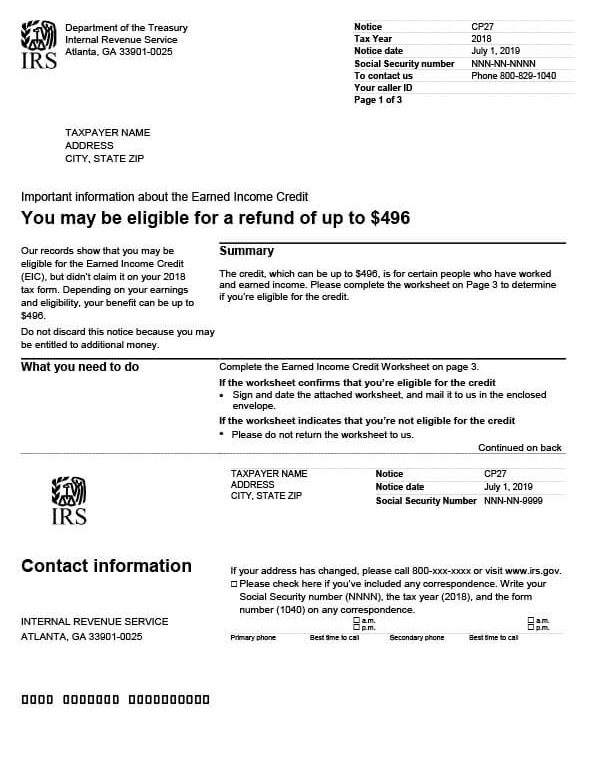

IRS Notice CP27 – Earned Income Credit (EIC)

IRS Notice CP27 is sent to taxpayers who may be eligible for the Earned Income Credit (EIC) but did not claim it on their returns. This notice is very similar to the CP09 notice, except that CP27 is sent to taxpayers who do not have qualifying dependents.

Why Did I Receive IRS Notice CP27?

You received IRS Notice CP27 because the IRS believes you may be eligible to receive the Earned Income Credit (based on your income) but you failed to claim it on your tax return. If eligible, this tax credit could result in a refund.

Next Steps

Review your CP27 notice and complete the Earned Income Credit Worksheet provided by the IRS. To determine your eligibility.

If you’re eligible:

- Sign and date the worksheet.

- Mail the completed worksheet using the envelope provided.

- The IRS will send your refund in 6-8 weeks. If you have an outstanding tax bill or government debt, however, your refund may be offset to pay toward that balance.

If you’re not eligible:

- Do not return the worksheet. No additional steps are required.

Who Should I Contact if I Have More Questions?

If you have questions regarding your IRS Notice CP27, call the number listed on your notice. You can also reach the IRS at 800-829-1040.