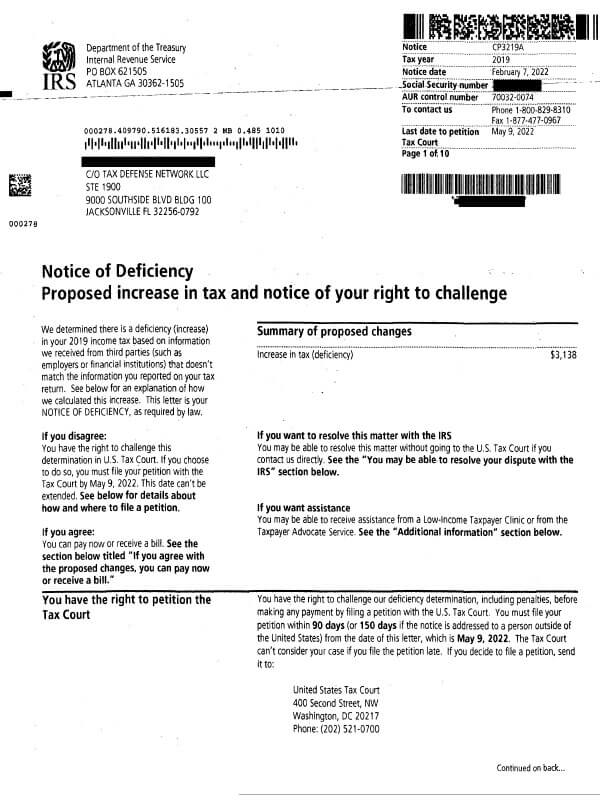

IRS Notice CP3219A – Notice of Deficiency

IRS Notice CP3219A is sent to a taxpayer when the information reported on their tax returns differs from the information received by the IRS. The IRS made changes to the return which may have increased or decreased the amount of tax owed.

Why Did I Receive IRS Notice CP3219A?

You received notice CP3219A because the IRS sent you previous notices requesting additional information about discrepancies (income, credits, or deductions) on your tax return. Since you did not respond by the required deadline dates on those notices, the IRS made the proposed changes to your return. Those adjustments resulted in a tax increase. CP3219A is not a bill. It is a summary of the proposed changes and explains your right to challenge the decision in U.S. Tax Court.

Next Steps

Review your CP3219A carefully. It will include a summary of proposed changes, as well as how much you now owe. If you do not respond to the notice, the IRS will assess the additional tax you owe, including any applicable penalties and interest fees, and send you a bill.

If you agree:

- You can pay some or all of the amount now, or wait for a bill. Be sure to sign and date Form 5564, Notice of Deficiency Waiver, and mail it to the correct address.

| For full or partial payments… | If waiting for a bill… |

|---|---|

| Internal Revenue Service Kansas City, MO 64999-0204 | Internal Revenue Service PO Box 621505 Atlanta, GA 30362-1505 |

If you disagree:

- You may be able to resolve your dispute directly with the IRS. Submit Form 5564 (included with your notice) or send a signed statement explaining why you disagree to PO Box 621505, Atlanta, GA 30362-1505. You may also fax these items to the number listed on your notice.

- You also have the right to challenge the deficiency determination, including penalties, by filing a petition with the U.S. Tax Court. You must file within 90 days from the date of your CP3219A (or 150 days if you live outside the U.S.). If you file after the deadline, the Tax Court won’t consider your case.

You can download the required petition form by going to www.ustaxcourt.gov or by contacting the Clerk of the U.S. Tax Court at the address provided in your CP3219A notice. There is a $60 filing fee.

Who should I contact if I have more questions?

To speak to someone regarding your IRS Notice CP3219A, call the number listed on your notice. You can also call Tax Defense Network at 855-476-6920 for a free consultation. We’ll review your case and see if you qualify for tax relief.