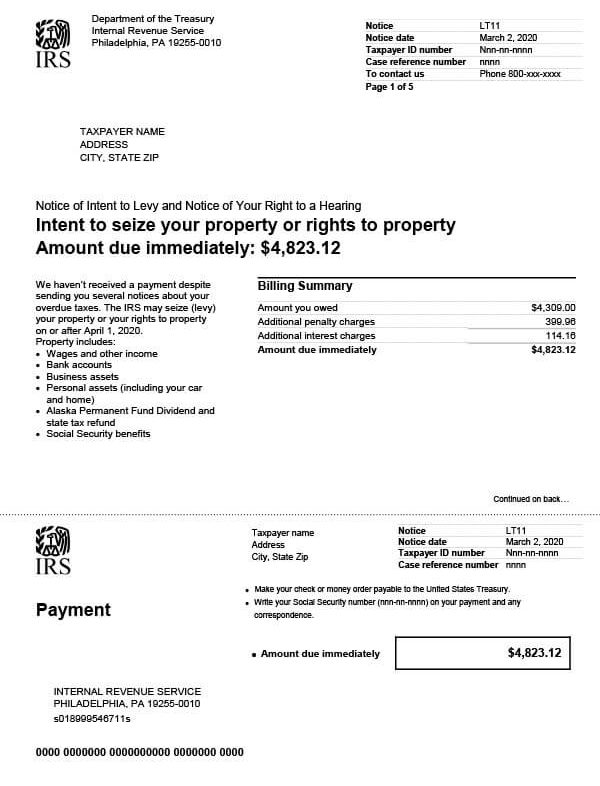

IRS Notice LT11 – Final Notice, Intent to Levy

IRS LT11 is a written notification, required by law, informing a taxpayer that the IRS intends to seize (levy) their assets.

Why Did I Receive IRS LT11?

You received IRS LT11 because you have back taxes and they were not paid by the deadline date. The IRS sent several notices informing you of your tax debt, but you failed to take any action. They now intend to levy your assets to pay off your debt. This may include but is not limited to your wages, bank accounts, property, and future tax refunds (state and/or federal).

Next Steps

Carefully review your LT11 and keep a copy for your records. It will provide your billing details, as well as a summary of what you now owe. Additionally, it will explain your right to request a Collection Due Process hearing.

If you agree with the amount:

- Pay your balance immediately or make arrangements to pay your balance off over time (installment agreement).

- If you’ve already paid in full, send proof of payment to the address provided in the letter.

If you wish to appeal:

- Complete and mail Form 12153, Request for a Collection Due Process or Equivalent Hearing, by the deadline date. Be sure to include the reason why you are requesting the hearing, as well as all other information requested on the form. If you don’t mail it before the deadline date, you will lose your right to contest the decision in U.S. Tax Court.

Failure to respond to the letter will put your wages and assets at risk. The IRS can levy your assets and also file a Notice of Federal Tax Lien (if it hasn’t done so already). Your passport may also be in jeopardy, depending on the amount you owe.

Who should I contact if I have more questions?

For questions about your IRS LT11, please call the number listed on the letter. You can also contact Tax Defense Network at 855-476-6920 and request a free consultation. Our tax specialists may be able to assist you with securing an affordable payment plan or other types of tax relief.