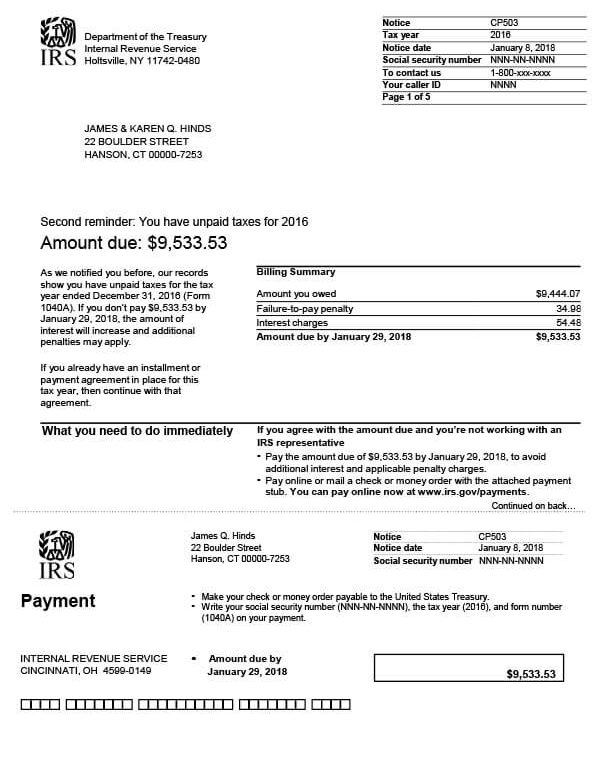

IRS Notice CP503 – Unpaid Tax Balance

IRS Notice CP503 is sent to taxpayers who continue to ignore repeated requests for payment on their unpaid tax balances.

Why Did I Receive IRS Notice CP503?

You received notice CP503 because the IRS sent you several other notices, including CP501, and you failed to respond or pay your balance due.

Next Steps

Thoroughly read your CP503 notice and keep a copy for your records. You have 21 days from the date of the notice to reply or pay your balance.

If you agree with the amount due:

- Pay your balance in full by the deadline date to avoid additional penalties and interest charges. For payment by check or money order, use the payment stub provided. You can also pay online at www.irs.gov/payments.

- If you can’t pay the entire balance by the deadline date, apply for a payment plan and send what you can now. You can also explore other types of tax relief, such as Currently Not Collectible status or an Offer in Compromise.

If you disagree with the amount due:

- Call the IRS at the number listed on your CP503 notice. Have your account information available so you can discuss your concerns with an IRS representative.

If you do not respond by the deadline date provided, the IRS will file a Notice of Federal Tax Lien if it hasn’t done so already.

Who Should I Contact if I Have More Questions?

For questions regarding your IRS Notice CP503, please contact the IRS at the number on the notice or 800-829-1040. For assistance setting up a payment plan or exploring your other tax relief options, call Tax Defense Network at 855-476-6920 for a free consultation.