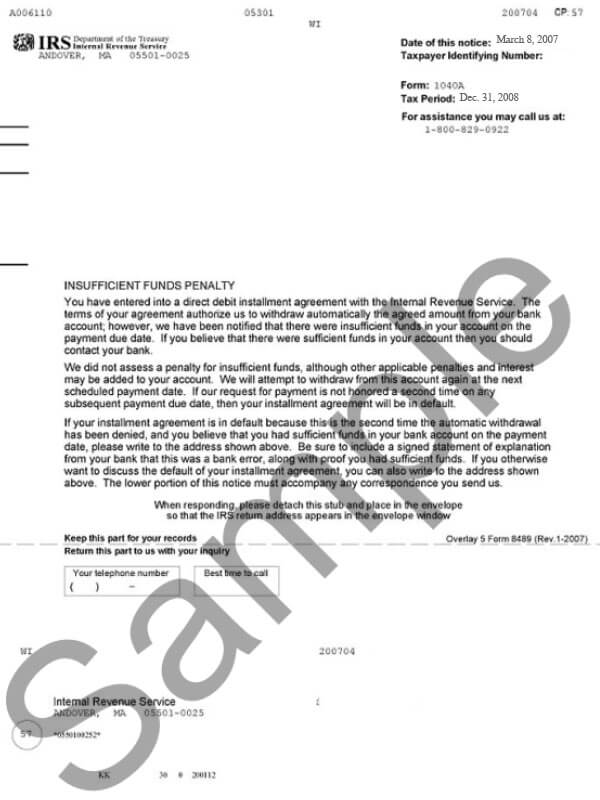

IRS Notice CP57 – Insufficient Funds Penalty

IRS Notice CP57 is sent to a taxpayer when the IRS attempts to automatically withdraw an authorized installment agreement payment but the bank rejects the request due to insufficient funds.

Why Did I Receive IRS Notice CP57?

You received IRS Notice CP57 because you have an installment agreement with the IRS and set up automatic payments through your bank account. Unfortunately, when the IRS attempted to withdraw the scheduled payment, it was declined due to insufficient funds. If this was the second time the IRS tried to withdraw your funds without success, your agreement is now in default.

Next Steps

If you believe that there was a bank error and you had adequate funds to cover your scheduled installment agreement payment, you should contact your bank immediately. Additionally, you should write to the IRS at the address provided on the lower portion of the notice. Any correspondence should include the following:

- A signed statement from your bank that they made an error

- Proof you had sufficient funds at the time of the attempted withdrawal

Be sure to include the bottom section of the letter with your correspondence, as well. In the event that you did not have sufficient funds, be sure to send in payment as soon as possible to avoid defaulting on your agreement. As always, keep a copy of IRS Notice CP57 for your records.

Who Should I Contact if I Have More Questions?

If you have questions concerning your IRS Notice CP57, contact the number listed on the notice or 800-829-1040. It may also be a good idea to speak with a tax professional if you’re in danger of defaulting on your IRS payment plan. A tax specialist can help you determine your next steps and see if you qualify for other tax relief assistance. Call 855-476-6920 to speak with Tax Defense Network today!