IRS Notice CP49 – Refund Offset

A taxpayer receives IRS Notice CP49 when part or all of their expected refund is offset to pay an outstanding government debt or overdue taxes.

Why Did I Receive IRS Notice CP49?

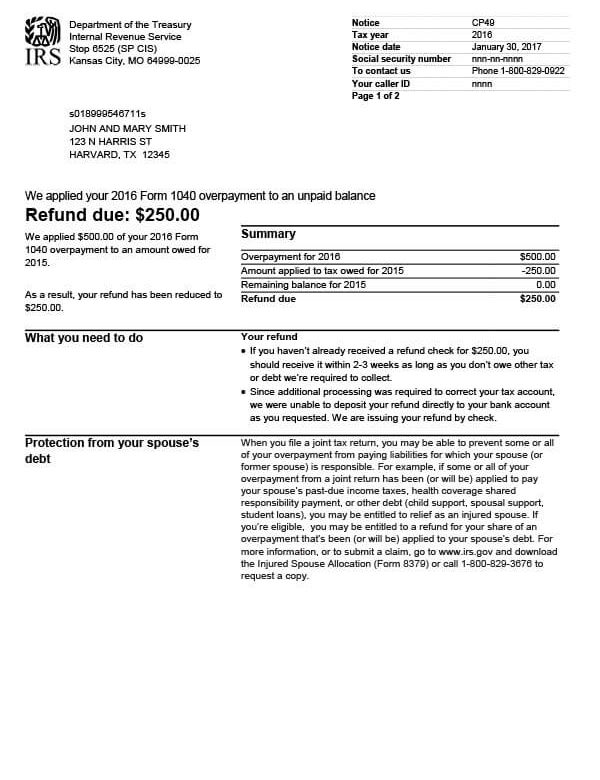

You received IRS Notice CP49 because you previously filed taxes and did not pay your tax balance in full. When you filed for the current tax year, you were due a refund. All or part of your tax refund was applied to pay your outstanding tax balance or other government debt.

Next Steps

Read your CP49 notice carefully. It will list your initial refund amount, how much was applied to your tax debt, and any remaining balance.

If you agree with the notice:

- Nothing additional is required. If you have any refund remaining, the IRS will mail it to you in a few weeks.

- Keep a copy of the notice for your records.

If you disagree with the notice:

- Call the IRS at the phone number listed at the top of your notice. Have a copy of the CP49 notice, your return(s), and any supporting documentation on hand before you call.

- Reach out to a tax professional. Depending on your circumstances, you may be eligible for various tax relief programs.

Who Should I Contact if I Have More Questions?

If you have questions about your IRS Notice CP49, call the number listed on the notice or 800-829-1040. You may also contact Tax Defense Network at 855-476-6920 for a free consultation to see if you qualify for an installment agreement, Offer in Compromise, or other tax relief options.