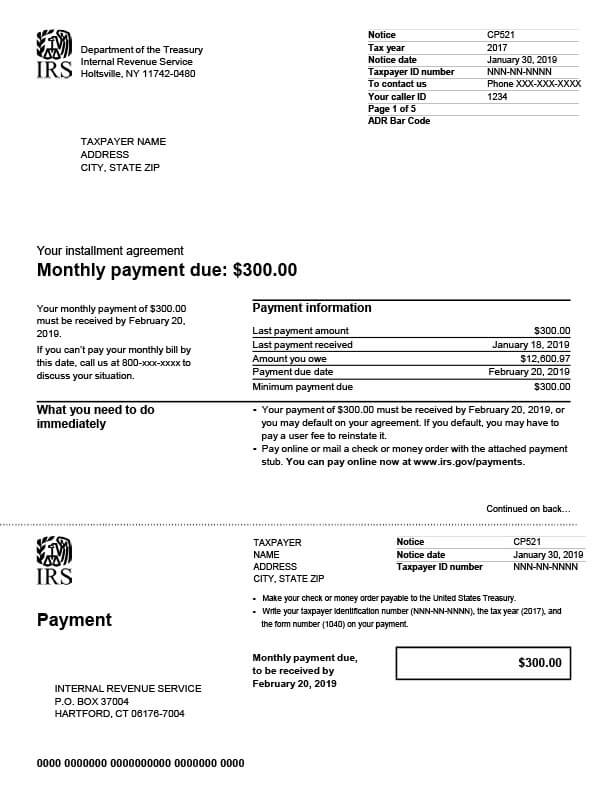

IRS Notice CP521 – Installment Agreement Payment Due

IRS Notice CP521 is sent to taxpayers to remind them to make their scheduled payment on their installment agreement immediately.

Why Did I Receive IRS Notice CP521?

You received notice CP521 because you have an installment agreement (payment plan) with the IRS. Your monthly payment is now due. You must submit your payment by the due date or you may default on your agreement.

Next Steps

Carefully review your CP521 notice. It will include a summary of the amount you owe, as well as any penalty and interest charges. Be sure to make your payment by the due date. You can send a check or money order with the payment stub provided or you may pay online at www.irs.gov/payments.

If you do not make your payment on time, you may default on your agreement. When this happens, you may have to pay a user fee to reinstate it or the IRS may resume collection actions. You can disregard the notice if you paid your balance in full within the past 21 days.

If you are unable to make your monthly payment, contact the IRS immediately at the phone number listed on the notice.

Who Should I Contact if I Have More Questions?

For questions regarding your IRS Notice CP521, please call the IRS at the number listed on your notice or 800-829-1040.