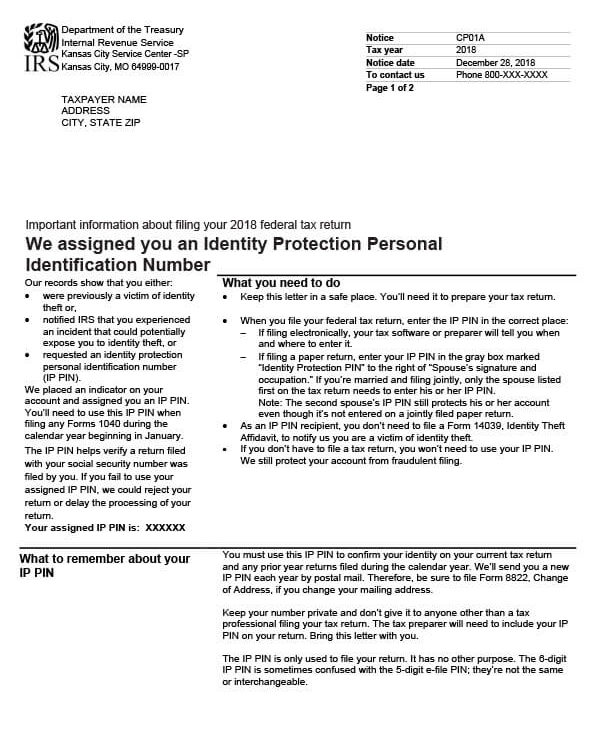

IRS Notice CP01A – Identity Protection Personal Identification Number (IP PIN)

The IRS sends out CP01A notice to taxpayers who have been assigned an identity protection personal identification number (IP PIN). This 6-digit PIN protects your tax account from potential fraud.

Why Did I Receive IRS Notice CP01A?

IRS Notice CP01A is sent to taxpayers who are victims of identity theft and have filed Form 14039, Identity Theft Affidavit. The notice will include your new IP PIN and instructions on how to use it.

Next Steps

Be sure to securely store your CP01A notice with your tax records and protect your IP PIN. Do not share it with anyone other than your tax preparer.

Here are some other important things to remember about your IP PIN:

- It’s only valid for your federal income tax returns.

- If you fail to include it when e-filing, your return will be rejected.

- Each year, you’ll receive a new IP PIN by postal mail (December/January).

If you misplace your IP PIN, visit Retrieve Your Identity Protection PIN (IP PIN) for instructions on how to recover your unique 6-digit PIN.

Who Should I Contact if I Have More Questions?

For additional questions about your IP PIN, please contact the IRS at 800-908-4490. You can also visit the FAQs About The Identity Protection Personal Identification Number (IP PIN) page to find answers to commonly asked questions about the IP PIN.