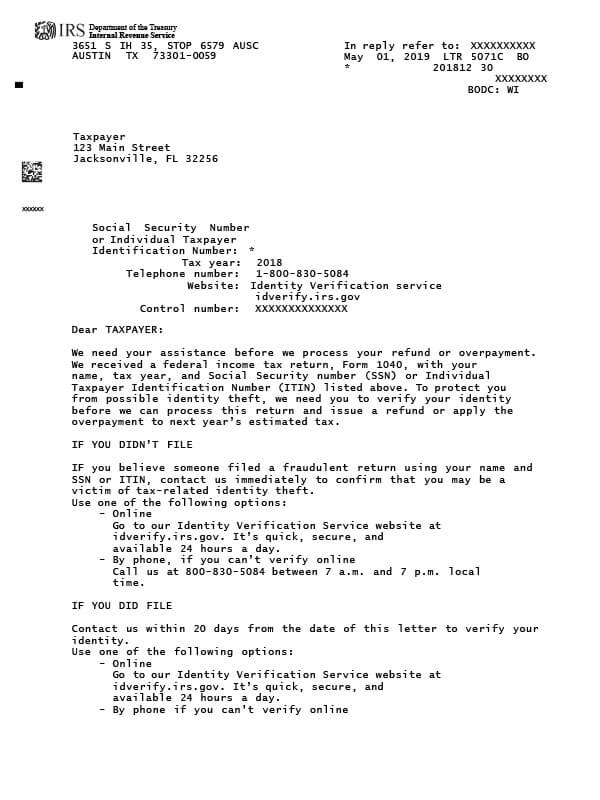

IRS Letter 5071C – Taxpayer Identity Verification Request

IRS Letter 5071C is sent to a taxpayer when the IRS needs to verify their identity before processing their tax return.

Why Did I Receive IRS Letter 5071C?

You received IRS Letter 5071C because the IRS is unable to verify your identity. It could be that someone else already filed using your name and Social Security number (SSN), or the IRS needs additional information before processing your return.

Next Steps

Read your 5071C letter thoroughly. It will explain how to use the online Identity Verification Service (idverify.irs.gov) to confirm your identity, as well as how to contact the IRS by phone. Before going online or calling, be sure to have the following items on hand:

- Your 5071C letter,

- The income tax return referenced in the letter,

- A prior-year tax return, other than the one referenced in the letter, and

- All supporting documents you filed with each of those returns (W-2s, 1099s, schedules, etc.).

If you are unable to respond within the 30-day time limit, don’t panic. The IRS will work with you regardless of how much time has passed. Your tax return, however, will not be processed until your identity is confirmed.

Who should I contact if I have more questions?

If you have questions about your IRS Letter 5071C, call the number listed on the letter for help.