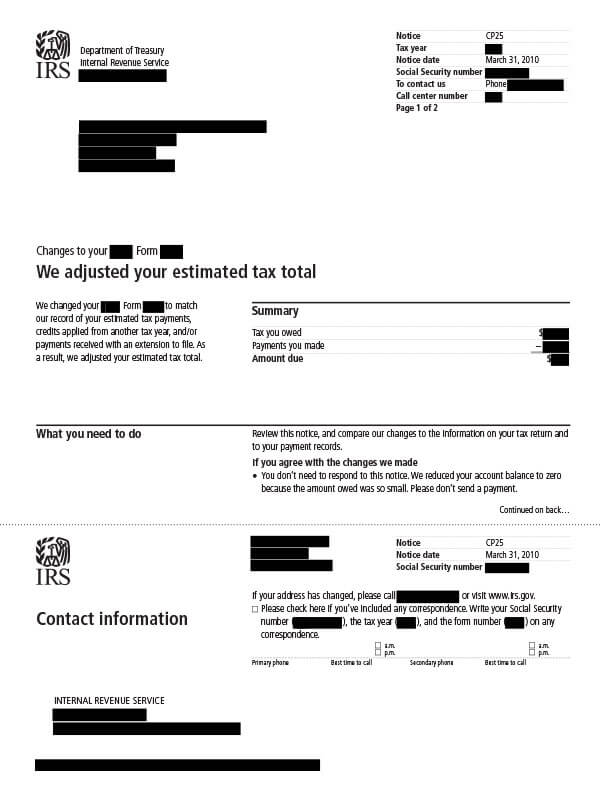

IRS Notice CP25 – Estimated Tax Payments/Zero Balance Due

The IRS will send notice CP25 if there is a difference between the amount of estimated tax payments on a taxpayer’s return and the amount posted to their account, which required the IRS to make changes. The changes to the return, however, did not result in any additional tax owed or a refund.

Why Did I Receive IRS Notice CP25?

You received IRS Notice CP25 because the IRS found a discrepancy on your tax return regarding your estimated tax payments. The IRS made changes to your return which resulted in a zero tax balance due.

Next Steps

Carefully read your IRS CP25 notice. It will explain any changes made to your return, as well as list the payments applied to your account.

If you agree with the changes:

- Correct your tax return copy and keep it for your records. Do not send an updated version to the IRS.

If you disagree with the changes:

- Call the IRS at the number listed on your tax notice within 60 days of the notice’s date. Be sure to have a copy of the notice, your tax return, and estimated tax payment information (canceled checks) on hand.

- If you prefer to dispute the changes in writing, you can send a letter by mail to the address provided in your notice. Include a copy of your notice and any relevant documentation to support your case. Please allow 60 or more days for a resolution.

Who Should I Contact if I Have More Questions?

If you need assistance with IRS Notice CP25, call the number listed on your notice or call 800-829-1040.