Form 8889, Health Savings Accounts (HSAs)

IRS Form 8889 is used by taxpayers to report contributions to and distributions from health savings accounts (HSAs). Taxpayers also use Form 8889 to figure out any amounts that must be included in their income, determine their HSA deductions, and calculate any additional tax that may be owed.

Who Should File IRS Form 8889?

If you made contributions to an HSA, or your employer contributed on your behalf, you are required to file IRS Form 8889. You must also file if you took any withdrawals from your account during the tax year.

How to Complete Form 8889

IRS Form 8889 is a short, one-page form with three parts. Be sure to include your name at the top of the form as it is shown on your Form 1040, 1040-SR, or 1040-NR. If you are married and file jointly, list both names as they appear on your tax return. You must also include the Social Security number for whomever has an HSA.

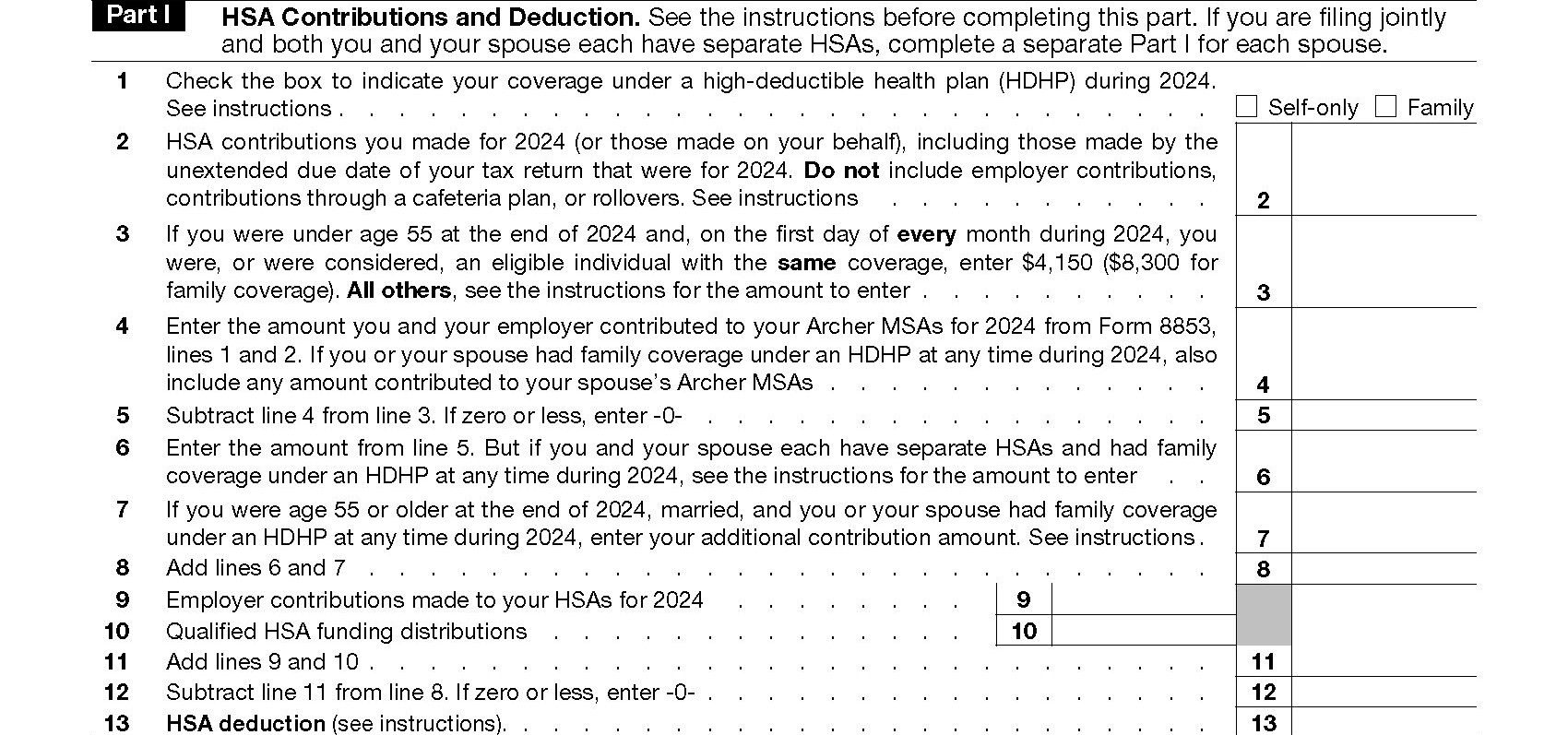

Part 1 – HAS Contributions and Deduction

In this section, you will figure out your HSA deduction and any excess contributions made by you or on your behalf. This includes excess contributions made by your employer. If you have self-only coverage, your maximum contribution is $4,150. For family coverage, the maximum is $8,300. If you are 55 or older at the end of the tax year, you can make an additional contribution of $1,000.

You cannot deduct any contributions for any month you were enrolled in Medicare. If you are listed as a dependent on another taxpayer’s return, you are ineligible to deduct any contributions made during the tax year.

Line 1 – Check either the “self-only” or “family” box. If you were covered by both during different times of the tax year, select the one that was in effect for the longest period. If you were covered by both during the same period, check the “family” box.

Line 2 – Include only contributions you made or those made by others on your behalf. Do not include any employer contributions on this line or amounts rolled over from another HSA.

Line 3 – If you were 54 or younger at the end of the tax year and you had the same coverage for all 12 months of the year, enter $4,150 (self-only) or $8,300 (family). If you were 55 or older and meet the same conditions, you can increase the amount by $1,000 if you use the “self-only” option. For those using the “family” option, the additional amount is figured on line 7. Those who changed coverage during the year, see the instructions for help in determining the amount to enter here.

Line 4 – Taxpayers with an Archer MSA will enter their contribution amount on line 4. Otherwise, you can enter “0” on this line.

Line 5 – Subtract line 4 from line 3 and enter the amount here.

Line 6 – Enter the amount from line 5 unless you and your spouse had separate HSAs and family coverage under a high deductible health plan (HDHP) during the tax year. If so, follow the instructions for calculating your contribution limit.

Line 7 – If you were 55 and older and married at the end of the tax year, use the following to determine your additional contribution amount:

- $1,000 x number of months eligible = ________________

- Divide line 1 (above) by 12 and enter the result on line 7. For example, if line 1 is $9,000, you would enter $750 ($9,000/12 = $750).

Please note that both of the following must apply to take the additional contribution:

- You or your spouse had family coverage under an HDHP and were considered an eligible individual on the first day of the month; and

- You were NOT enrolled in Medicare for the month.

If both apply to all 12 months of the tax year, enter $1,000 on line 7.

Line 8 – Add lines 6 and 7. Place the result here.

Line 9 – Include any amount your employer contributed to your HAS during the tax year. You should also include any contributions made by a health insurance plan on an employer’s behalf (box 12 of Form W-2 with code W).

Line 10 – If you had distributions from a traditional IRA or Roth IRA sent to your HAS, enter the amount here.

Line 11 – Add lines 9 and 10. Enter the result here.

Line 12 – Subtract line 11 from line 8. Enter the amount here.

Line 13 – Enter the smaller of line 2 or line 12 here. If line 2 is larger than line 13, you may owe additional tax.

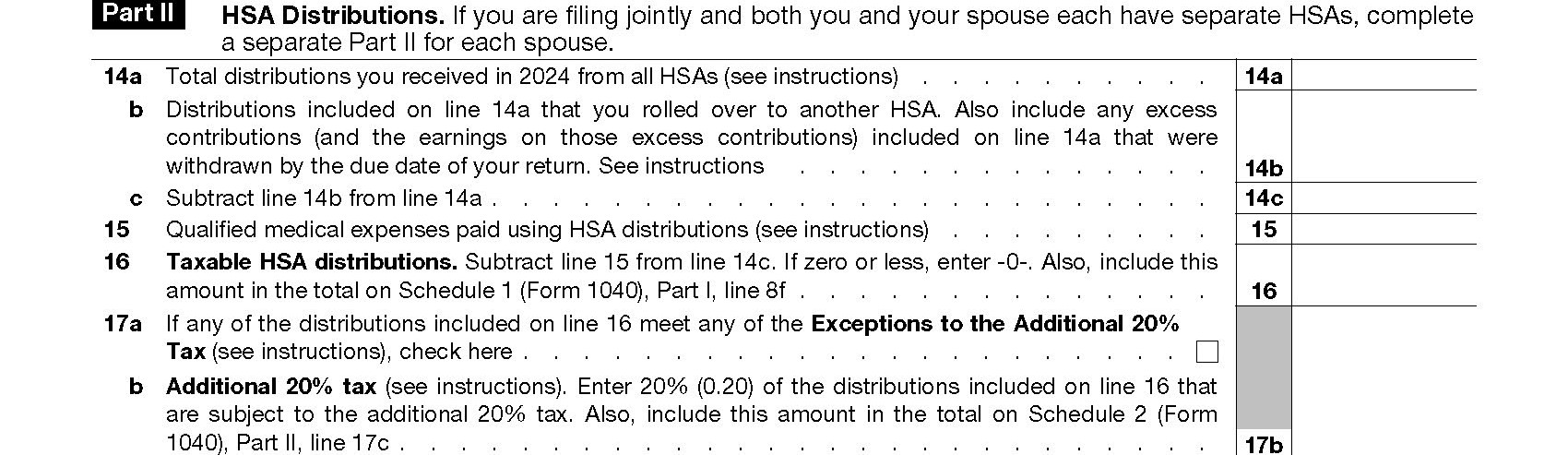

Part II – HAS Distributions

If you file jointly and have separate HSAs, you’ll need to complete a separate Part II for yourself and your spouse.

Line 14 – Enter the total of all distributions you received during the tax year on line 14a. Include amounts paid with a debit card that restricts payments to health care, as well as amounts withdrawn by other designated individuals. On line 14b, include any distributions you received that qualified as a rollover contribution to another HSA. Subtract line 14b from 14a and enter the total on line 14c.

Line 15 – Enter the total of all qualified medical expenses paid during the tax year. Do NOT include any expenses reimbursed by insurance or other coverage, or those incurred before establishing your HSA.

Line 16 – Subtract line 15 from line 14c and enter the total here.

Line 17 – If you (or your spouse) were 65 or older during the tax year, disabled, or died, the additional 20% tax does not apply to your distributions. Check the box on line 17a. If none of these exceptions apply, do not check the box.

For line 17b, enter 20% of any amount included in line 16 that does not meet any of the exceptions. For example, if you turned 65 on June 1, any distributions received from January until June would be subject to the 20% tax. That total would be included here.

Part III – Income and Additional Tax for Failure to Maintain HDHP Coverage

Use Part III to figure additional income and/or adjustments that must be reported for failure to be an eligible individual. If you are filing jointly and you have separate HSAs, each spouse must complete a separate Part III, if applicable.

Line 18 – Use the Limitation Chart and Worksheet in the form instructions to determine the contribution you could have made if the last-month rule did not apply. On line 18, enter the excess of the amount contributed over the predetermined amount.

Line 19 – Enter the total of any qualified HSA funding distribution (refer to line 10).

Line 20 – Add lines 18 and 19. Enter the total here.

Line 21 – Multiply line 20 by 10% and enter the result here. You’ll also include this total on Schedule 2 (Form 1040), Part II, line 17d.

Need Help?

If you need help completing IRS Form 8889, please refer to the form instructions or contact Tax Defense Network at 855-476-6920. We offer affordable tax preparation services for individuals and small business owners.