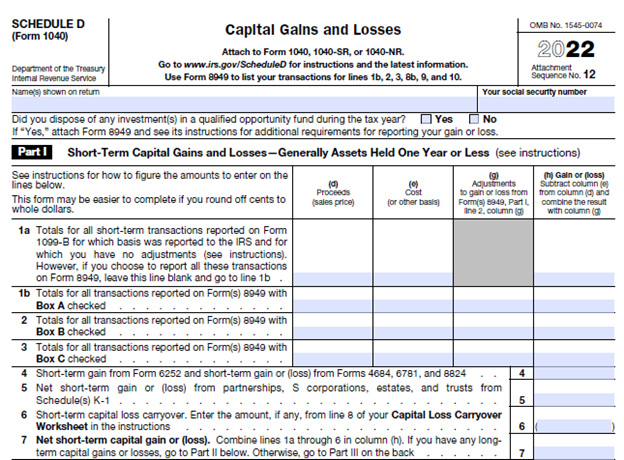

Schedule D (Form 1040), Capital Gains and Losses

Use Schedule D (Form 1040) to report the sale or exchange of a capital asset that is not reported on another form or schedule. This includes property you may own and use as an investment or for personal purposes, such as stocks, bonds, or real estate.

Who Uses Schedule D?

Schedule D is used by individual taxpayers to help calculate their capital gains and losses. It also helps determine what taxes, if any, are due. You will likely need to file Schedule D (Form 1040) if you:

- Sell investments, such as cryptocurrency

- Sell a business property

- Have a casualty or loss theft

- Made a like-kind exchange

- Have installment sale income

Additional tax forms, such as Form 8949, are often required when completing Schedule D. The gains and losses calculated on Schedule D are combined with other income and deductions on IRS Form 1040 to determine your tax liability.

How to Complete Schedule D

Schedule D (Form 1040) is only two pages long. In Part I, you’ll report all short-term capital gains and losses. Long-term gains and losses are reported in Part II. The final page (Part III) is a summary.

You may round off cents to whole dollars when completing Schedule D. If you do round, amounts under 50 cents drop down to the previous dollar. For example, $1.49 would be $1.00. Amounts between 50 cents and 99 cents are rounded up. So, $1.69 would be rounded to $2.00. Do not round when adding figures together. If you are adding two or more amounts together, include the cents and then round the total.

Part 1, Short-Term Capital Gains & Losses

Before starting this section, be sure to read the instructions and complete any additional forms required. This may include:

- Form 8949, Sales and Other Dispositions of Capital Assets

- Form 6252, Installment Sale Income

- Forms 4684, Casualties and Thefts

- Form 6781, Gains and Losses From Section 1256 Contracts and Straddles

- Form 8824, Like-Kind Exchanges

If you have a short-term gain or loss from a partnership, S corporation, estate, or trust, you’ll need to complete Schedule(s) K-1, as well.

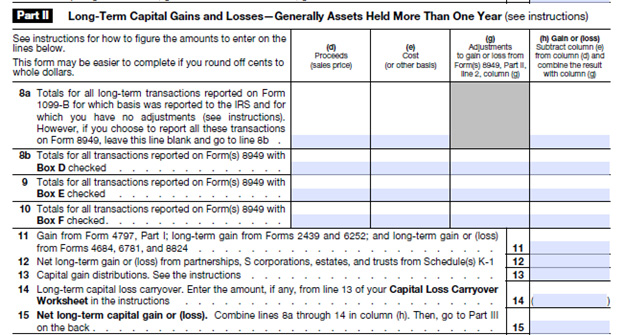

Part II, Long-Term Capital Gains & Losses

For Part II, you’ll need totals for all long-term transactions reported on Form 1099-B, as well as those reported on Form 8949. Additionally, you’ll need the total long-term gains from the following:

- Form 4797 (Part I), Sale of Business Property

- Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains

- Form 6252

You’ll also need the long-term gain or loss from Forms 4684, 6781, 8824, and Schedule(s) K-1, if applicable.

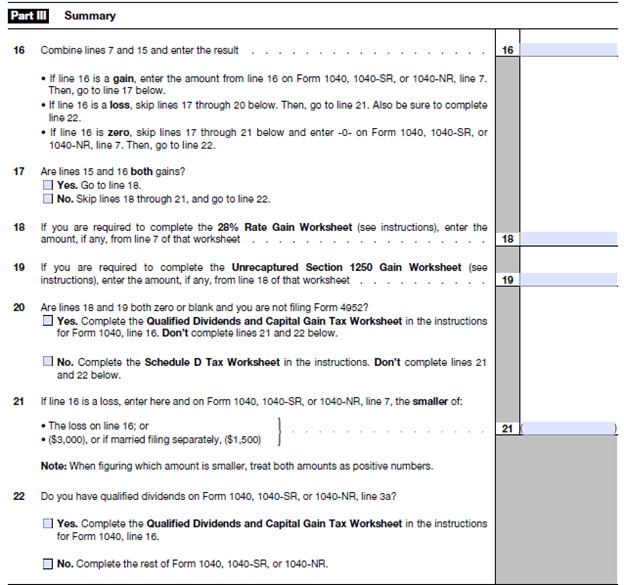

Part III, Summary

To complete the summary section, add lines 7 and 15, and place the result on line 16. If the result is zero, you can skip to line 22. If it is a loss, skip to line 21. For gains, move on to line 17.

If you check “yes” on line 17, you’ll need to complete the 28% Rate Gain Worksheet (line 18) and Unrecaptured Section 1250 Gain Worksheet (line 19) found in the Schedule D instructions. Otherwise, skip to line 22.

On line 20, complete Schedule D Tax Worksheet in the instructions if you answered “no” and then stop. If you answered “yes,” you’ll need to complete the Qualified Dividends and Capital Gain Tax Worksheet. Do not complete lines 21 and 22.

You will only complete lines 21 and 22 if you have a loss on line 16.

Need Help?

If you need help completing your Schedule D or any other tax forms, call Tax Defense Network at 855-476-6920 for a free consultation. We offer affordable tax preparation services for individuals and business owners.