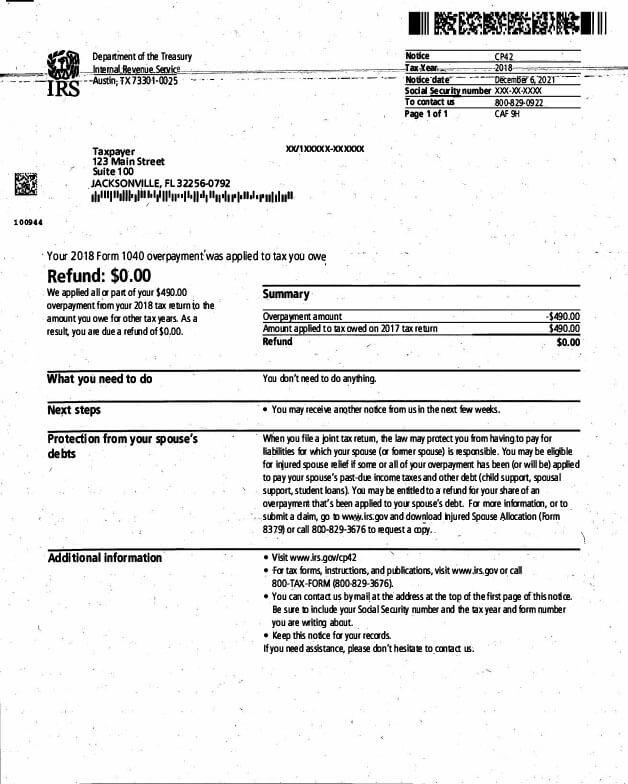

IRS Notice CP42 – Overpayment Applied to Spouse’s Balance Due

IRS Notice CP42 is sent to a taxpayer when part or all of their expected refund is offset to pay a spouse’s (or former spouse’s) unpaid taxes or government debt.

Why Did I Receive IRS Notice CP42?

You received IRS Notice CP42 because you previously filed a joint tax return and your spouse (or former spouse) has unpaid taxes or other debt, such as child support or defaulted student loans. You were due a refund on your current year’s tax return, but they applied part or all of that amount to your spouse’s outstanding balance since the debt was incurred during a year where you filed jointly.

Next Steps

Review your CP42 notice carefully. It will explain how the IRS used your refund and what amount, if any, is left.

If you agree with the notice:

- Nothing additional is required. If you have any refund remaining, it will be sent to you in a few weeks.

- Keep a copy of the notice for your records.

If you disagree with the notice:

- Contact the IRS at the phone number listed at the top of the notice. Be sure to have a copy of your notice, your return(s), and any supporting documentation readily available.

- Reach out to a tax professional. Depending on your circumstances, you may be able to request Injured Spouse Allocation (Form 8379) and have part or all of your refund returned.

Who Should I Contact if I Have More Questions?

If you need assistance with IRS Notice CP42, call the number listed on your letter. To explore your tax relief options, such as Injured Spouse Relief, contact Tax Defense Network at 855-476-6920. We offer a free, no-obligation consultation and case review.