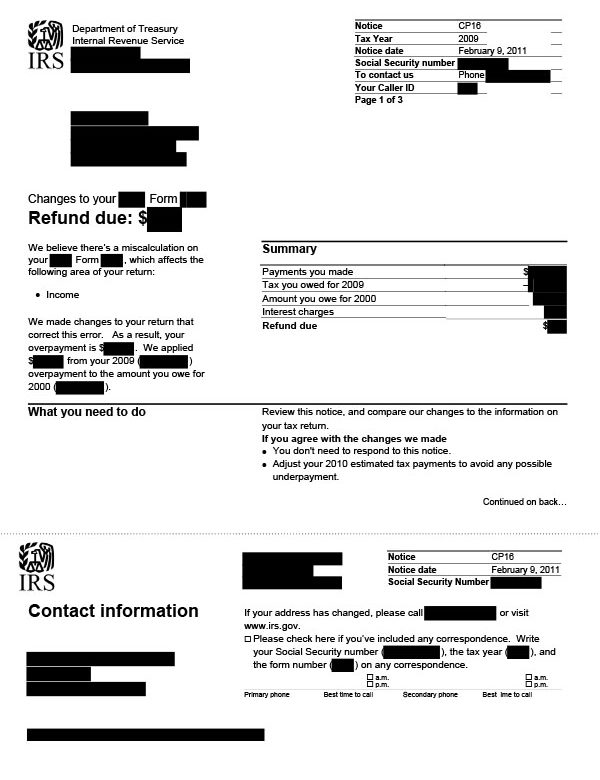

IRS Notice CP16 – Changes to Your Tax Form

IRS Notice CP16 notifies taxpayers of changes made to their tax return due to a miscalculation or other error. Those changes resulted in a refund, which was applied to an outstanding tax debt.

Why Did I Receive IRS Notice CP16?

You received CP16 because the IRS discovered an error on your tax return. When the error was corrected, it resulted in a refund. Unfortunately, the IRS offset this refund (partially or in full) to pay down your existing tax balance from a previous tax year.

Next Steps

Read your notice CP16 carefully. It explains the changes made to your tax return and why. If you were unaware of an outstanding tax balance, you can use the Get Transcript application to obtain a copy.

If you agree with the changes made:

- Correct your tax return and keep a copy for your records. Do not send the updated copy to the IRS.

- The IRS will apply your refund to your outstanding tax balance, even if you’re currently on a payment plan. If there are any funds remaining after the balance is paid in full, they’ll issue you a refund.

If you disagree with the changes made:

- Call the number listed on your notice to review your account with an IRS representative, or

- Contact the IRS by mail. Be sure to fill out the ‘Contact Information’ section, detach it, and include any supporting documentation.

You must contact the IRS within 60 days of receiving the notice if you want to dispute their decision. After 60 days, the IRS will not reverse any adjustments without adequate documentation and payment of the additional tax owed. You must also file Form 843, Claim for Refund and Request for Abatement.

Who Should I Contact if I Have More Questions?

If you need assistance with IRS Notice CP16, you can contact the IRS at the number listed on your notice. You may also request a free consultation with a tax specialist by calling Tax Defense Network at 855-476-6920.