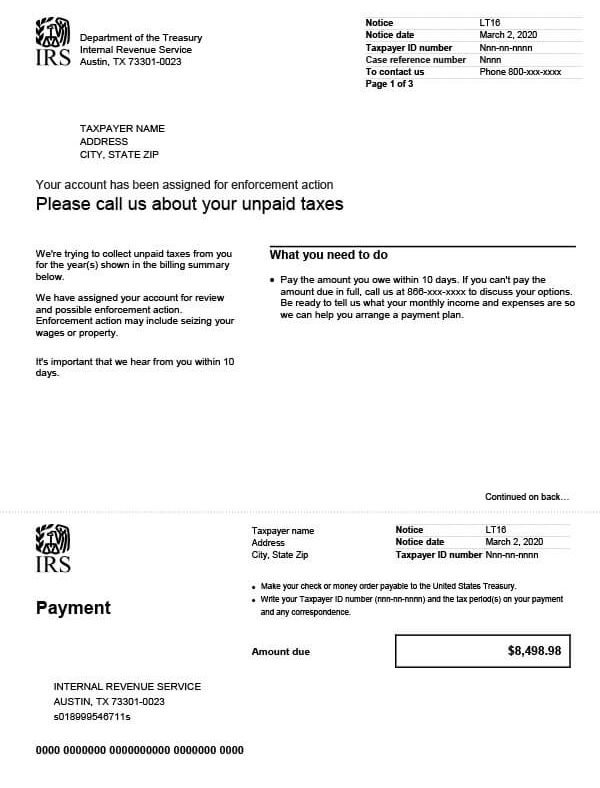

IRS Notice LT16 – Enforcement Action Notice

IRS LT16 is a simple notice informing a taxpayer that the IRS is trying to collect unpaid taxes and/or there are missing tax returns they need to file.

Why Did I Receive IRS LT16?

You received IRS LT16 because you did not file a required return by the due date or you have an unpaid tax balance. The IRS has sent multiple letters requesting that you file or make a payment, but you haven’t complied. LT16 notifies you that the IRS has assigned your account for enforcement (wage garnishment, tax levies, and/or liens) action. You now have 10 days to respond.

Next Steps

Carefully read your LT16 and save a copy for your records. It will include a detailed accounting of the taxes due, including interest and penalty fees. If there are missing tax returns, those years will be identified, as well.

If you agree with the amount due:

- Pay the amount you owe within 10 days.

- If you can’t pay in full, you may be eligible for a payment plan or other tax relief.

- If you paid your balance within the last 21 days, you can disregard the notice.

If you have any missing tax returns:

- File the missing returns as soon as possible.

- If you already filed and it’s been more than 10 weeks, send a signed copy of your return to the IRS.

- If there are one or more returns incorrectly reported as missing on your LT16, contact the IRS at the number listed on the letter.

You can also dispute the tax amount if you believe it is incorrect. If you can’t reach an agreement with the IRS, you also have the right to a hearing with the Office of Appeals.

Who should I contact if I have more questions?

For questions regarding your IRS LT16, please contact the IRS at the number listed on your letter. You can also call Tax Defense Network at 855-476-6920 and request a free consultation. Our tax professionals can help determine if you are eligible for various types of tax relief that can help you avoid IRS collection actions.