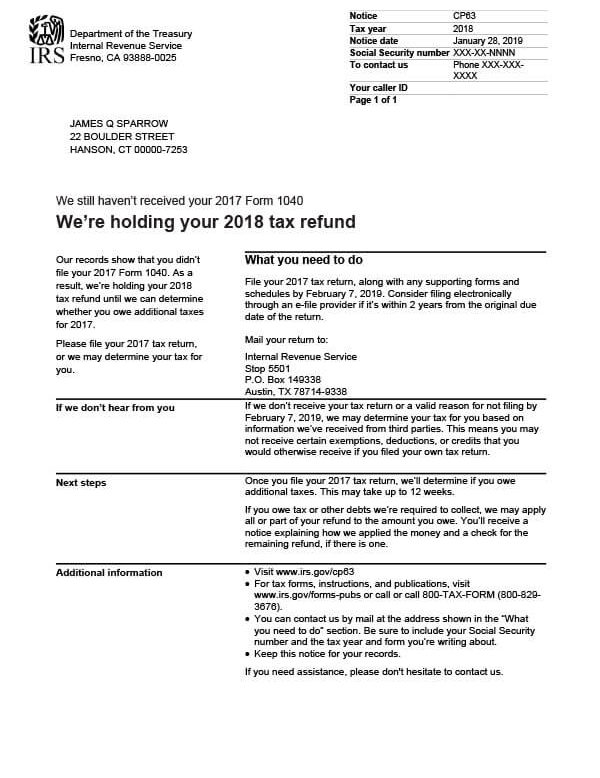

IRS Notice CP63 – IRS Holding Your Tax Refund

IRS Notice CP63 notifies taxpayers that their tax refund is being held due to an unfiled tax return from a previous year.

Why Did I Receive IRS Notice CP63?

You received a CP63 notice because you received a tax refund for the current tax year, but failed to file a tax return from a previous year. The IRS is now holding your tax refund while it reviews your missing tax year(s) and determines if you have a balance due.

Next Steps

File your tax return immediately. If it’s within two (2) years of the original filing deadline, you can file electronically through an e-file provider. You may also submit your return by mail to the address provided on your IRS CP63 notice.

If you don’t file your return or provide a valid explanation why you didn’t file on time, the IRS may prepare a Substitute for Return (SFR) and determine your tax based on information provided by third parties. In most cases, you will not receive any exemptions, credits, or deductions you would otherwise receive if you had filed on your own.

Once the IRS receives your missing tax return, it may take up to 12 weeks or longer for them to process it. If there is a balance due, all or part of your tax refund from the current tax year will be applied to the outstanding tax debt. Any remaining refund amount will be sent to you by check in the mail.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP63, call the number on your notice or 800-829-1040. For assistance with unfiled tax returns, call Tax Defense Network at 855-476-6920 for a free consultation and quote.