IRS Notice CP62 – Payment Applied

IRS Notice CP62 is sent to taxpayers when the IRS applies a payment to their account.

Why Did I Receive IRS Notice CP62?

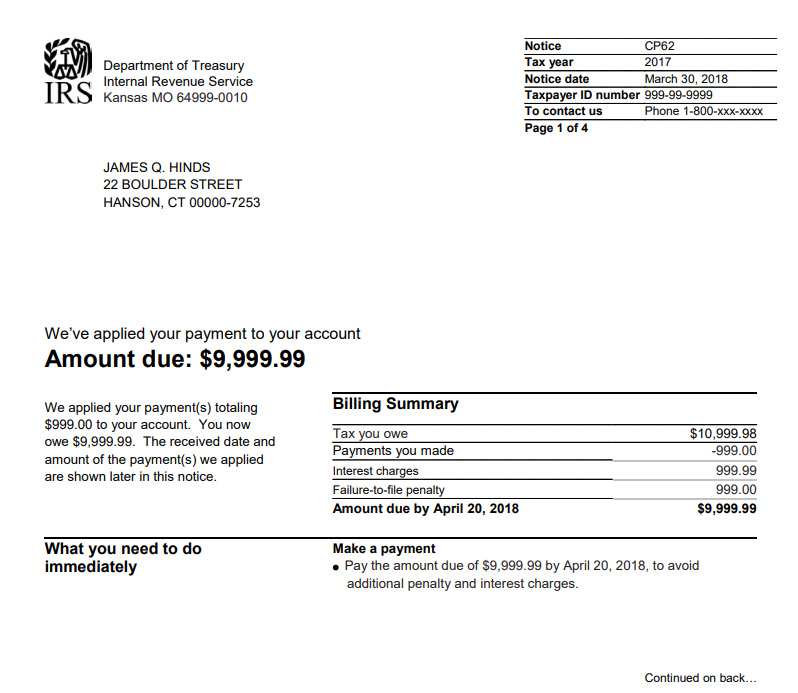

You received IRS Notice CP62 because you made a payment to your account. The IRS is confirming receipt of the payment and giving you an update on your outstanding balance.

Next Steps

Review your CP62 carefully. It will show the date and amount of the payment applied to your account. If the wrong amount was applied, call the IRS immediately at the number listed on the notice.

If your balance is now paid in full or you are due a refund:

- There is no need to respond to the notice. Refunds are generally received within 2-3 weeks.

If you still have an outstanding tax balance:

- You must pay the amount owed by the due date on your notice.

Taxpayers who cannot pay in full should pay what they can and make arrangements for the remaining balance. Options may include installment agreements, an Offer in Compromise, or other tax relief programs.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP62, or cannot pay the remainder of your tax balance, call the IRS at 800-829-8374. You can also explore your tax relief options by scheduling a free consultation with one of our tax experts by calling 855-476-6920.