Form 1098-E, Student Loan Interest Statement

Form 1098-E reports the amount of student loan interest you paid during the tax year. Student loan servicers send copies of Form 1098-E by email or postal mail if the amount was $600 or more. You can also download a copy of this form from your student loan account. Depending on your income level, you may be eligible to deduct a portion of your student loan interest on your tax return.

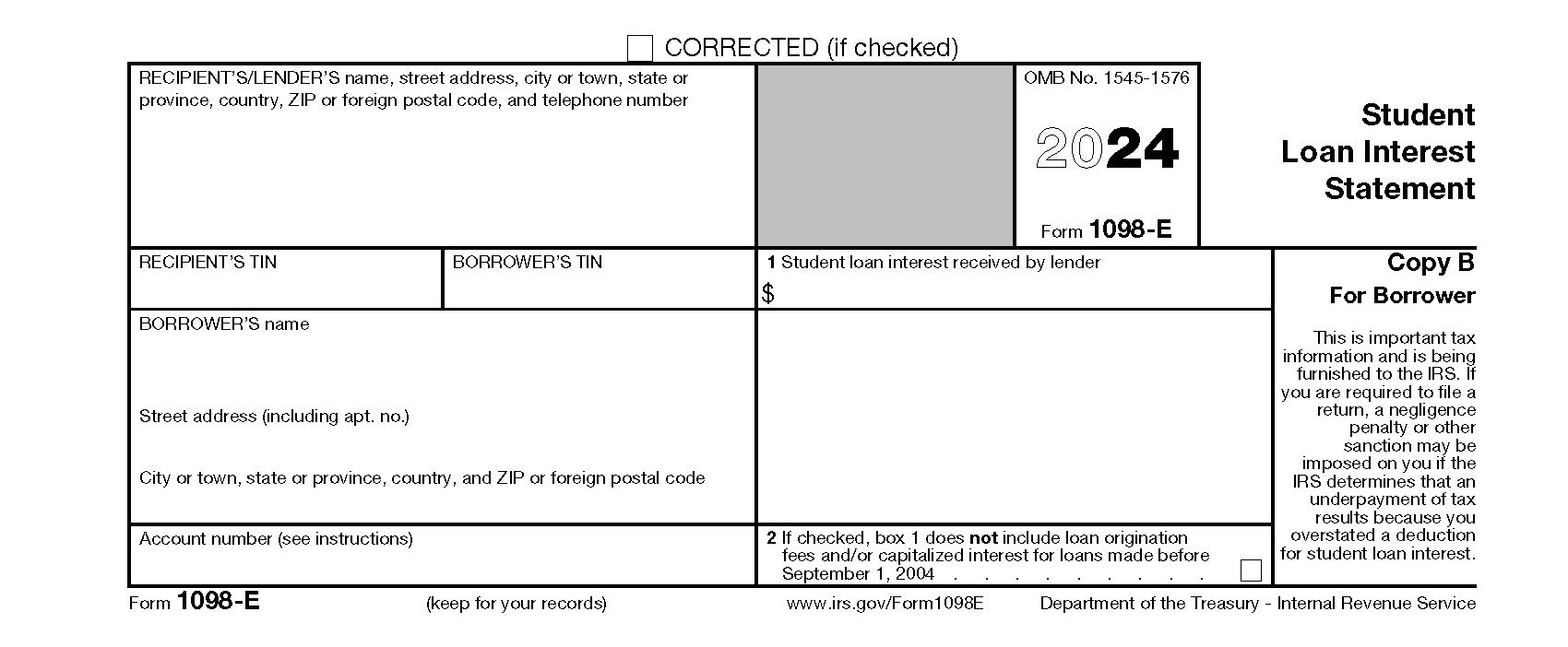

Sample Form 1098-E

Below is an example of Form 1098-E. It includes your student loan lender’s name, address, and tax identification number (TIN). It will also show your name (borrower), address, student loan account number, and your Social Security number (SSN) or other tax identification number (TIN). For your protection, only the last four digits are typically visible.

Box 1 shows the interest you paid during the year. This may be for one or more loans serviced by the lender.

If box 2 is checked, loan origination fees or capitalized interest is not included in the box 1 amount for loans made before September 1, 2004. You may, however, still be able to deduct those fees. Refer to IRS Publication 970 for assistance determining any deductible loan origination fees or capitalized interest.

How To Get a Copy of Form 1098-E

As we mentioned earlier, your student loan servicer should send you a copy of Form 1098-E for tax purposes. If you do not receive one, however, you can call your servicer or download a copy by logging into your account.

| Loan Servicer | Phone Number |

|---|---|

| HESC/Edfinancial | 855-337-6884 |

| MOHELA | 888-866-4352 |

| Aidvantage | 800-722-1300 |

| Nelnet | 888-486-4722 |

If you don’t know your loan servicer, you can log into StudentAid.gov or call 800-433-3243. Please note that you should have a separate 1098-E for each servicer.

Student Loan Interest Deduction

You may be eligible to deduct some or all of your student loan interest on your tax return if you meet certain income thresholds and other requirements.

Income Threshold

To take the student loan interest deduction, your modified adjusted gross income (MAGI) must not exceed $80,000 ($160,000 if filing a joint return).

Other Requirements

The interest is only deductible if you took out a qualified student loan and it was used to cover qualified education expenses.

Qualified student loans include those used for education for an eligible student. The loan may be for you, your spouse, or a dependent. Loans from relatives or qualified employer plans are ineligible.

The loan must also be used to pay qualified education expenses, such as:

- Tuition and fees

- Room and board

- Books, supplies, and equipment

- Transportation and other necessary expenses

If you meet the income threshold and other requirements, the deduction can reduce your taxable income by up to $2,500, even if you do not itemize.

Need Help?

If you need assistance with filing your taxes or determining your eligibility for tax credits and deductions, contact us at 855-476-6920. We offer affordable tax preparation and tax relief services.