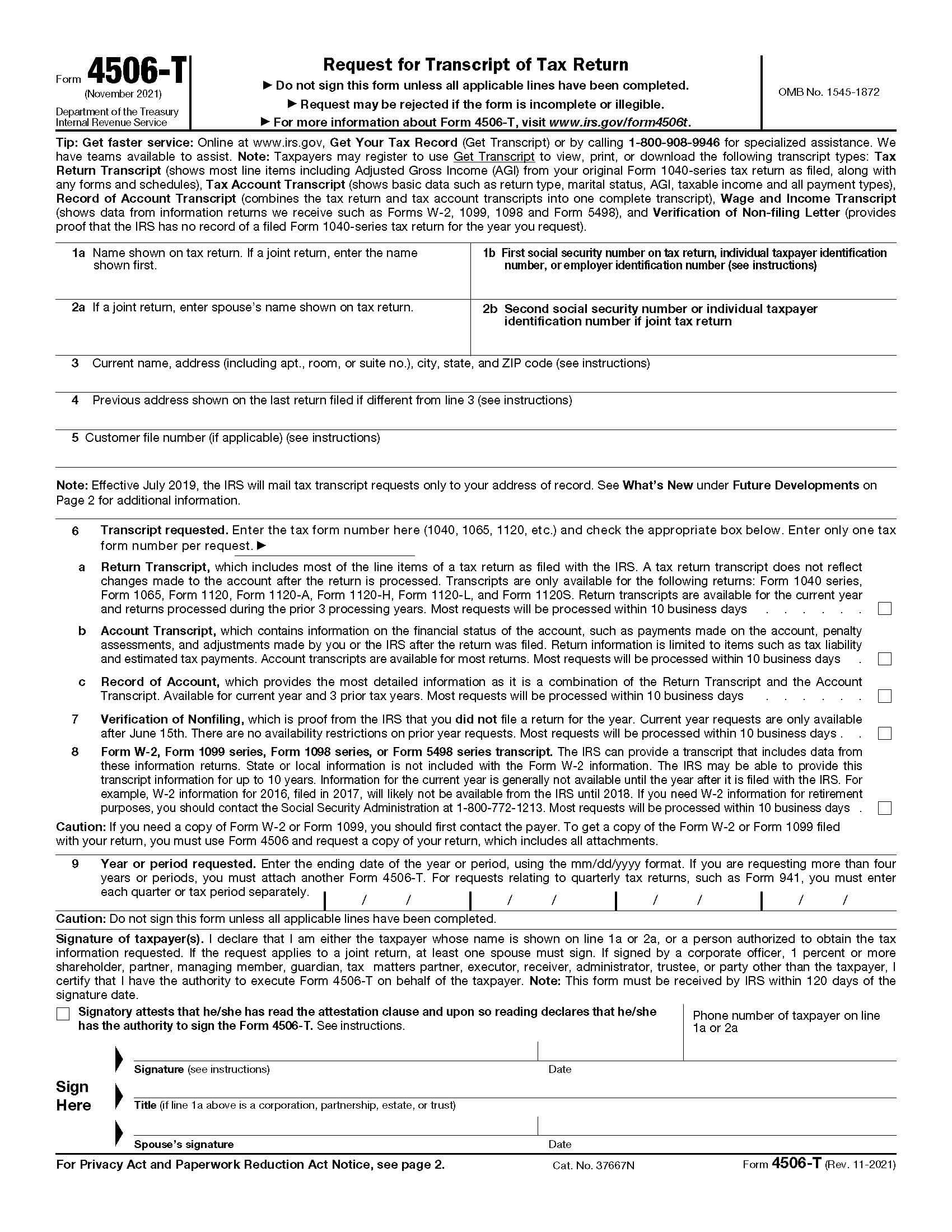

Form 4506-T, Request For Transcript of Tax Return

There are various situations where you may need a copy of your tax transcript. If you don’t have one on file, you can order one for free by completing Form 4506-T, Request for Transcript of Tax Return. You can also request a copy of your transcript by calling 800-908-9446 or by visiting the “Get Your Tax Record” page on IRS.gov.

What’s The Difference Between Form 4506 and 4506-T?

The main difference between Form 4506 and 4506-T is that 4506 is a request for an exact copy of your tax return and submitted documentation, not the shortened transcript. Form 4506 also takes much longer to process (up to 75 days) and there’s a $43 processing fee for each return requested.

Form 4506-T, on the other hand, is completely free and takes very little time to process. If you’re applying for government benefits, a mortgage, or have another situation where your tax information may be required, a transcript will generally suffice.

How to Complete Form 4506-T

Line 1a. Enter your name or the first name shown on your tax return (if you filed a joint return).

Line 1b. Enter your social security number (SSN) or individual taxpayer identification number (ITIN), or the first one shown on your tax return (if you filed jointly). For businesses, enter your employer identification number (EIN).

Line 2a. Enter your spouse’s name if you filed a joint return. Otherwise, leave this blank.

Line 2b. For joint returns, enter your spouse’s SSN or ITIN. Leave blank if you filed on your own.

Line 3. Enter your current address. If you use a P.O. box, it should be entered here, as well.

Line 4. You don’t need to complete this box unless the address shown on your last tax return filed is different from the one listed on line 3.

Line 5. This line is optional. Enter up to 10 numbers to create a unique customer file number that will appear on your transcript. Do not include your SSN, ITIN, or EIN in the file number.

Line 6. Enter only one (1) tax form number (1040, 1065, etc.) on this line and then check the box next to the type of transcript you’d like to receive:

- Return Transcript

- Account Transcript

- Record of Account

Line 7. Check this box if you’d like to receive Verification of Nonfiling.

Line 8. If you’d like your transcript to include data from your W-2, Form 1099, Form 1098, or Form 5498, check this box. If you need an actual copy of any of these forms, however, you’ll need to submit Form 4506.

Line 9. Enter the ending date of the year or period requested. If you need more than four years or periods, you’ll need to complete more than one Form 4506-T. For quarterly tax return requests, you must enter each separately.

Sign the form. Be sure you or your spouse (if applicable) sign and date the form (both signatures are not required). You must also check the box in the signature area to attest that you have the authority to sign and request the information. If you fail to check the box, the IRS will not process your request and return the form to you.

Where to File Form 4506-T

Form 4506-T must be received by the IRS within 120 days of the date you place in the signature area.

For individual transcript requests (Form 1040 series, Form W-2, and Form 1099), mail your form to the address below that corresponds with your state.

| If you live in: | Mail or fax to: |

|---|---|

| Florida, Louisiana, Mississippi, Texas, a foreign country, American Samoa, Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, or A.P.O. or F.P.O. address | Internal Revenue Service RAIVS Team Stop 6716 AUSC Austin, TX 73301 Fax: 855-587-9604 |

| Alabama, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kentucky, Maine, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, North Carolina, Oklahoma, South Carolina, Tennessee, Vermont, Virginia, Wisconsin | Internal Revenue Service RAIVS Team Stop 6705 S-2 Kansas City, MO 64999 Fax: 855-821-0094 |

| Alaska, Arizona, California, Colorado, Connecticut, District of Columbia, Hawaii, Idaho, Kansas, Maryland, Michigan, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, Washington, West Virginia, Wyoming | Internal Revenue Service RAIVS Team P.O. Box 9941 Mail Stop 6734 Ogden, UT 84409 Fax: 855-298-1145 |

For business transcript requests, send your Form 4506-T to the address assigned for your state.

| If you live in or your business is located in: | Mail or fax to: |

|---|---|

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming, a foreign country, American Samoa, Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands, A.P.O. or F.P.O. address | Internal Revenue Service RAIVS Team P.O. Box 9941 Mail Stop 6734 Ogden, UT 84409 Fax: 855-298-1145 |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service RAIVS Team Stop 6705 S-2 Kansas City, MO 64999 Fax: 855-821-0094 |

Need Help?

If you need assistance getting your tax transcript or any other tax forms, please contact Tax Defense Network at 855-476-6920. We offer affordable tax services, such as tax preparation, tax audit representation, and so much more!