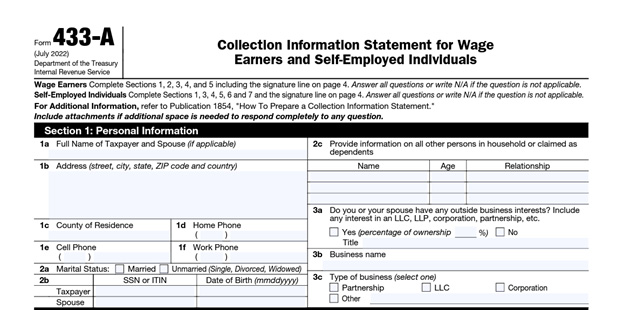

Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals

IRS Form 433-A is used to obtain financial information necessary for the IRS to determine your ability to satisfy an outstanding tax debt. This includes your income and assets, as well as any expenses and liabilities.

Who Should File Form 433-A?

You may need to complete Form 433-A if:

- You owe back taxes on Form 1040,

- You are responsible for a trust fund recovery penalty,

- You are personally responsible for a partnership tax liability,

- You are the owner of a limited liability company (LLC) that is a disregarded entity, or

- You are self-employed or have self-employment income.

How to Complete Form 433-A

IRS Form 433-A has several sections that must be completed. Individual wage earners should complete sections 1 through 5, including the signature line on page 4. Those who are self-employed should complete section 1, as well as sections 3 through 7, including the signature line on page 4. If you are a wage earner who also has self-employment income, complete ALL sections. Be sure to answer each question or write “n/a” if the question is not applicable.

Section 1 – Personal Information

This section is pretty straightforward. Provide your contact information, marital status, Social Security number (SSN) or Individual Tax Identification Number (ITIN), and your date of birth. If you are married, you will need to provide these for your spouse, as well. You will also need to include information on anyone living in your home and your business interests.

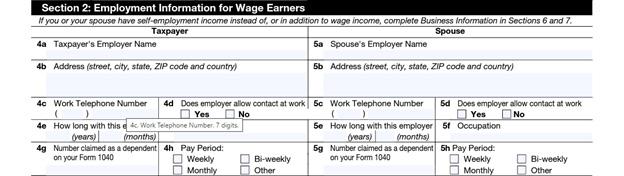

Section 2 – Employment Information For Wage Earners

Only wage earners will complete section 2 of Form 433-A. In this area, provide your employer’s name and contact information. Provide your occupation and length of employment, as well as pay frequency. You should also indicate whether you can be contacted at work and how many dependents you claimed on your Form 1040. If married, complete the same information for your spouse.

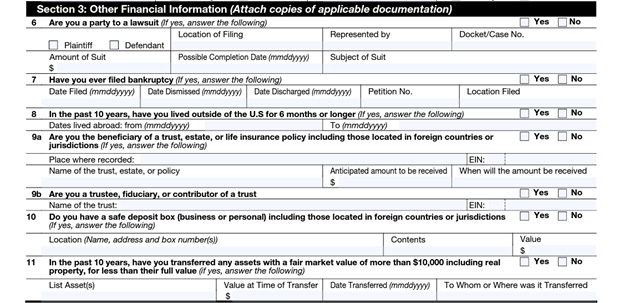

Section 3 – Other Financial Information

In section 3, you will need to answer questions regarding your personal finances, including:

- Any active legal cases

- Your bankruptcy filing status

- Information on any dates you lived outside the U.S.

- The location of any safe deposit boxes

- Any assets valued over $10K that were transferred for less than fair market value

- Your status as a trustee, fiduciary, or contributor of a trust

Additionally, you must indicate whether you are a beneficiary of a trust, estate, or life insurance policy. You are also required to attach copies of documentation to support any claims in this section.

Section 4 – Personal Asset Information For All Individuals

Section 4 is quite extensive and may take some time to complete. In this area, you will need to provide detailed information on all bank accounts and investments, as well as digital assets. You will also need to list all lines of credit and bank-issued credit cards. If you own life insurance, you’ll need to provide policy numbers, current cash value, and any outstanding loan balances.

In addition to cash assets, you’ll need to list any real property you own or are currently buying. Personal vehicles and other personal assets (furniture, jewelry, artwork, etc.) must also be included in this section. You may include attachments if additional space is required to respond.

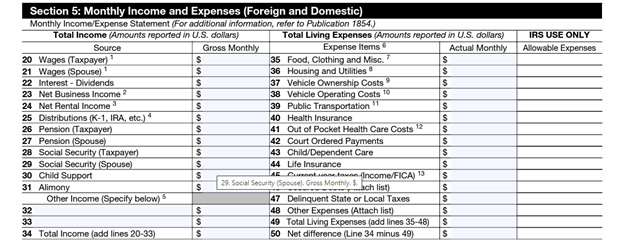

Section 5 – Monthly Income and Expenses

If you are self-employed, do not complete section 5 until you complete sections 6 and 7 first! In section 5, you will need to list out all wages, interest, and dividends. Additionally, you will need to provide the amount you receive monthly through retirement funds, pensions, and/or Social Security. If you receive child support or alimony, it will need to be included, as well. Those with business or rental income will also include that information in section 5.

In addition to income, you’ll need to list out all monthly living expenses, such as food, transportation, and health care. If you are married and live in a community property state or share expenses, you must also list your spouse’s financial information, even if they are not responsible for the tax debt in question.

Don’t forget to sign and date the certification box at the bottom of page 4, which is directly under section 5.

Section 6 – Business Information

If you are an individual wage earner who doesn’t have any self-employment income, do not complete this section. Self-employed taxpayers must provide their business information in section 6 of Form 433-A. This includes the business name and contact information, as well as tax deposit and payroll details. You must also list out all payment processors and credit cards accepted by your business. Additionally, include your business bank account details and accounts/notes receivables. Finally, list all business assets.

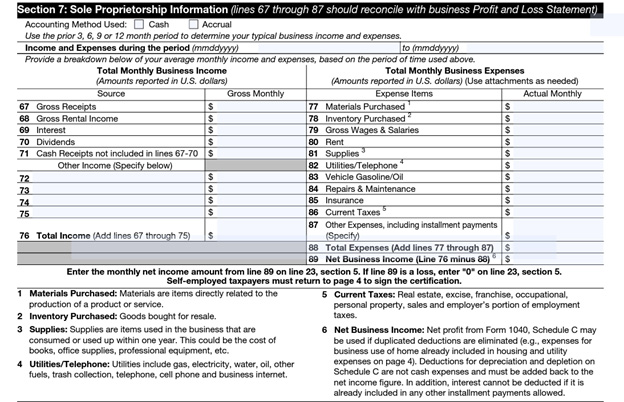

Section 7 – Sole Proprietorship Information

Only those who are self-employed should complete section 7. In this area, you will include a breakdown of your monthly business income, expenses, and the accounting method used. Make sure that lines 67 through 87 reconcile with your profit and loss statement.

Once you’ve completed sections 6 and 7, go back and fill in section 5 before sending the form to the IRS.

Need Help?

Since the information provided on Form 433-A will help determine your eligibility for certain tax relief programs, we highly recommend working with a tax professional to ensure it is correctly filled out. If you need assistance completing IRS Form 433-A, please contact Tax Defense Network at 855-476-6920. You may also refer to IRS Publication 1854, How to Prepare a Collection Information Statement, for additional information.