Form 14039, Identity Theft Affidavit

Form 14039, Identity Theft Affidavit, is used by a taxpayer when someone else uses their Social Security number (SSN) to file a tax return. The form alerts the IRS about potential tax fraud.

Who Should File Form 14039?

In many cases, the IRS will catch potential tax fraud, such as identity theft, before it becomes a problem. When this happens, they typically reach out to you to request additional information to help verify your identity before a suspicious return is accepted. Other times, you may discover that someone has falsely used your tax information to file when your online return is rejected.

Generally, there are four (4) instances when you should file IRS Form 14039:

- You suspect someone has used your SSN to fraudulently file a tax return because your e-file return is rejected.

- The IRS has sent you a notice or letter requesting you submit an identity theft affidavit.

- Someone has fraudulently used your dependent child’s or dependent relative’s SSN to file taxes and you are submitting on their behalf.

- You are submitting on behalf of another taxpayer (living or deceased) because you are the surviving spouse, court-appointed representative, or have Power of Attorney (Form 2848).

Do not submit IRS Form 14039 if your dependent’s identity was misused by your former spouse or another guardian. It is not considered identity theft.

How to Complete IRS Form 14039

IRS Form 14039 consists of two (2) pages with six (6) sections. You can fill out the paper form and submit it by mail, or you can complete it online. It is strongly recommended that you also apply for an Identity Protection Personal Identification Number (IP PIN) if you don’t already have one.

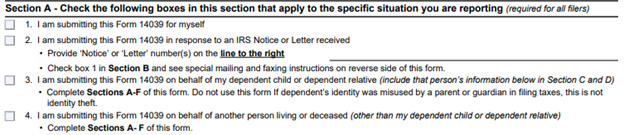

Section A – Which Situation Are You Reporting?

In this section, you must check one of the four (4) boxes provided to indicate why you are filing an identity theft affidavit. If it’s in response to an IRS letter or notice, check box 2 and provide the notice/letter number on the line to the right. You will also need to check box 1 in section B and follow the instructions on the back of the form. For boxes 1, 3, or 4 in section A, complete all other sections on Form 14039.

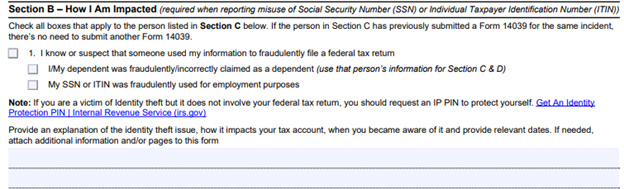

Section B – How Am I Impacted

Check all boxes that apply to the person impacted by the identity theft. Briefly explain when you first became aware of the issue (include relevant dates) and how it has impacted your tax account.

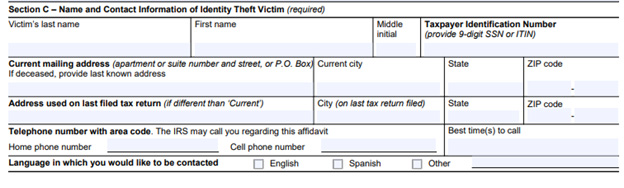

Section C – Contact Information of Identity Theft Victim

Include the name, taxpayer identification number (TIN or SSN), address, and telephone number of the person impacted by the identity theft. If the current address is different from the one provided on their last tax return, include that as well. You should also provide the best time for the IRS to reach that person and their preferred language.

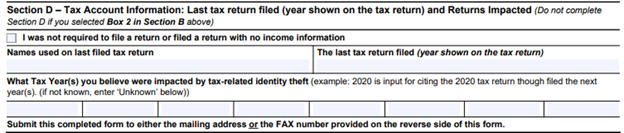

Section D – Tax Account Information

For this section, you’ll need to include information on the previous year’s tax return (name on return and year filed) and the tax years impacted by the identity theft.

Section E – Penalty of Perjury Statement and Signature

The person impacted by the identity theft, or their legal representative, must sign and date this section.

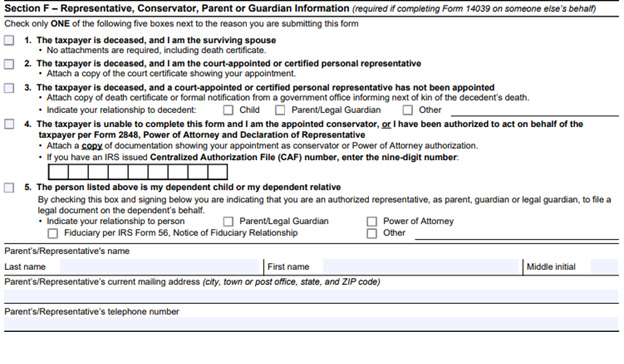

Section F – Representative Information

If you are submitting this form on behalf of another taxpayer, your dependent child, or a dependent relative, check the appropriate box (1 through 5). Be sure to include your name, address, and phone number at the bottom of the section.

Where to Submit IRS Form 14039

If you completed the paper form, you can either submit it by fax or postal mail.

- Fax Submission – Include a cover sheet marked “confidential” and send it to 855-807-5720. If you are submitting Form 14039 in response to an IRS letter or notice, fax it to the number provided on the letter/notice. If no fax number was provided, follow the mailing instructions provided on the notice/letter.

- Postal Mail – If you checked box 1 or 2 in section B and are unable to file your return electronically because your SSN/TIN was misused, attach Form 14039 to the back of your paper tax return and mail it to the IRS location where you typically submit your return. All others (boxes 3-5) should mail the identity theft affidavit to: Department of Treasury, IRS, Fresno, CA 93888-0025.

Once the IRS receives your form, it will send an acknowledgment letter and refer your case to the Identity Theft Victim Assistance organization for processing. This can take up to 180 days, but you’ll be notified once the case is settled.

Need Help?

If you need help completing IRS Form 14039, please visit IRS.gov. For other tax assistance, contact Tax Defense Network at 855-476-6920. We specialize in tax relief programs but can also assist with individual or business tax preparation.