Form 8857, Request for Innocent Spouse Relief

When you file a joint tax return, it makes both you and your spouse responsible for any taxes due. This is known as joint and several liability. The IRS can still hold you liable and take collection actions against you for any balance due, even if you separate or file for divorce after filing your return. A divorce decree stating that your spouse is solely responsible for the tax debt will not waive your tax liability either. If you believe that you should not be held accountable for the joint tax debt, however, you may file IRS Form 8857 to request innocent spouse relief.

Who Should File Form 8857?

You should file Form 8857 and request relief if the following are true:

- You filed a joint return.

- There was an understated tax on the return due to erroneous items submitted by your spouse.

- You can provide evidence that when you signed the return you were unaware that any understatement of tax or incorrectly claimed deductions/credits existed.

- It would be unfair to hold you liable for the tax debt given the facts and circumstances.

If you are being held accountable for tax attributed to community income, relief may also be available if you were a resident of a community property state and did not file a joint federal tax return.

Separation of Liability Relief

In certain circumstances, the IRS may allow separation of liability for taxes due on a joint return if the person you filed with has died or you are now:

- Divorced or legally separated, or

- Living apart for the 12 months prior to filing Form 8857.

The IRS may also consider equitable relief if it believes that it would be unfair to hold you liable for the joint tax debt.

When to File IRS Form 8857

You should file IRS Form 8857 as soon as you are aware of the joint tax debt for which you believe only your spouse (current or former) is responsible for paying. For example, after receiving a tax notice. Generally, however, you have two (2) years to file from the first attempt by the IRS to collect the tax debt. Examples of IRS activities that start the 2-year clock include tax offset, wage garnishment, and receiving a notice of intent to file a tax lien or levy.

How to Complete Form 8857

IRS Form 8857 had a total of six (6) pages and seven (7) parts.

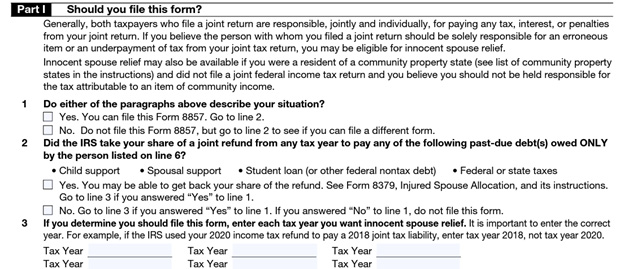

Part I – Should You File This Form?

In Part I, answer the three questions to determine if you’re eligible to use Form 8857.

Part II – Personal Information (You and your spouse)

In this section, you’ll need to provide information on your primary language, current name and address, as well as your spouse’s name and contact information. Additionally, you’ll need to indicate your current marital status with whom you jointly filed, your highest level of education, and list any physical or mental problems.

Part III – Information Regarding Preparation of Joint Return

Part III consists of several questions related to the preparation of your joint tax return. This includes your involvement in preparing the forms, as well as your knowledge about your spouse’s income. You’ll also need to explain what you knew about any missing information and any financial problems that existed at the time of filing.

Part IV – Current Financial Situation

In this area, you’ll need to list your current assets, as well as your monthly income and expenses for your entire household.

Part V – Domestic Violence or Abuse

If you were or are now a victim of domestic violence or abuse, answer the questions in this section. Otherwise, check no and move to the next part.

Part VI – Additional Information

Use Part VI to include any additional information you’d like the IRS to consider when reviewing your request for spousal relief.

Part VII – Refund

Check the box in the section if you’d like a refund for any tax you already paid.

Be sure to sign and date the form, and attach all supporting documentation, before submitting Form 8857 to the IRS. Once the form is received, the IRS will contact your spouse to ask them if they would like to participate in the process. After the IRS has all the necessary information, they will send a preliminary determination letter to you and your spouse. If you agree with the decision, it will be finalized. If either party appeals, however, the IRS will withhold its final determination until after the appeals process concludes.

Need Help?

If you’re unsure if you qualify for innocent spouse relief, please contact Tax Defense Network at 855-476-6920. We offer a free consultation and can determine if you’re eligible for this or other types of tax relief.