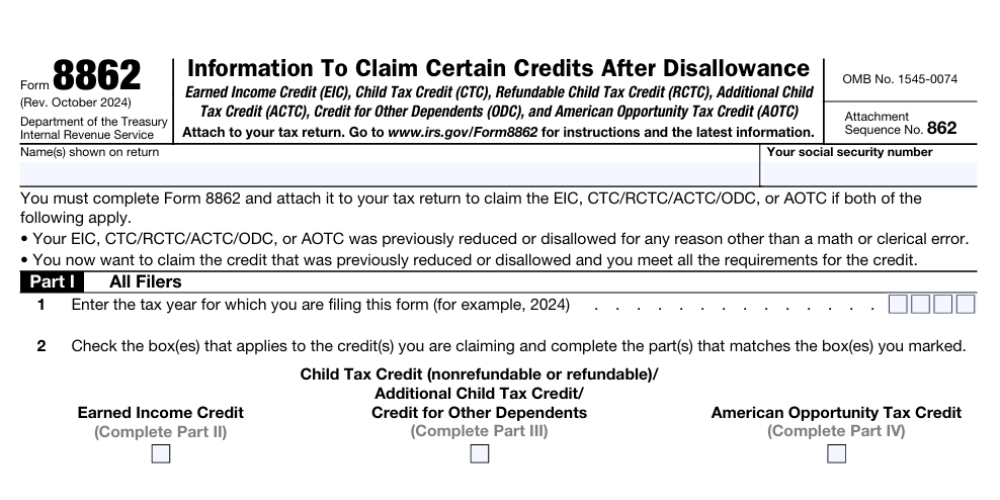

Form 8862, Information to Claim Certain Credit After Disallowance

IRS Form 8862 is used by taxpayers to claim certain refundable credits after the IRS previously disallowed them. This includes the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), Credit for Other Dependents (ODC), and American Opportunity Tax Credit (AOTC).

Who Should File IRS Form 8862?

If you previously claimed one of the above-mentioned tax credits on your tax return and the IRS did not allow it, but you now believe that you are eligible to claim the credit, you should include Form 8862 with your current tax return.

Do not file Form 8862 if any of the following apply:

- After your credit was reduced or disallowed in a previous tax year, you (a) filed Form 8862 and your credit was then allowed, and (b) your credit has not been disallowed or reduced again for any reason other than a math or clerical error.

- You are claiming the Earned Income Tax Credit (EITC) without a qualifying child and the only reason the credit was reduced or disallowed previously was because the IRS determined that the child listed was not your qualifying child.

In these two instances, you may claim the credit without filing IRS Form 8862. Additionally, you cannot file Form 8862 if:

- It’s been less than two years since the most recent tax year that the IRS provided a final determination and it was due to reckless or intentional disregard of the rules, OR

- It’s been less than 10 years since the IRS determined you could not claim the credit due to fraud.

In these two cases, you are ineligible to claim the credit.

How to Complete Form 8862

Be sure that you meet all requirements for the tax credit you wish to claim before submitting IRS Form 8862. All fliers must complete Part I. Depending on which tax credit(s) you are claiming, you will also need to complete the parts that are specific to it. We’ll go over each section below.

Part I

In Part I, you must enter the tax year for which you are filing Form 8862, not the year it was disallowed. You must also check the box(es) for any credit(s) you are claiming and then complete the section(s) (Part II, III, or IV) for the credit(s). Don’t forget to put your name and Social Security number (SSN) in the space provided. If you are married and file jointly, include your spouse’s information, as well.

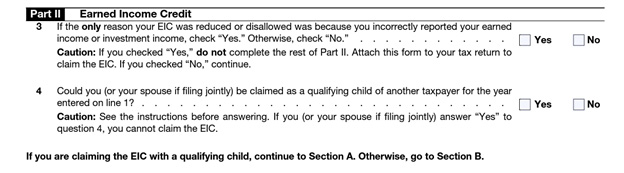

Part II – Earned Income Tax Credit

Complete Part II if you are claiming the Earned Income Tax Credit (EITC).

Line 3 – If you were previously denied the EITC due to incorrectly reporting your earned income or investment income, check box yes. You do not need to complete any other sections of the form. Simply attach Form 8862 to your tax return.

If you checked “no” for line 3, you should complete the remainder of Part II.

Line 4 – Answer the question about being claimed as a qualifying child on another taxpayer’s return. If you checked “yes,” you cannot take the EITC. Taxpayers with a qualifying child will need to complete Section A. Those without a qualifying child should move to Section B.

Section A

Before working on this section, you will need to complete Schedule EIC for the tax year claimed on line 1 of IRS Form 8862.

Line 5 – Enter the names of your child(ren).

Line 6 – If your EIC Schedule does not show that you had a qualifying child for the year you are claiming it, do not complete Section A. Instead, move to Part II, Section B. If you checked “yes,”, continue to the next question in Section A.

Line 7 – Enter the number of days each qualifying child lived with you in the U.S. during the tax year provided on the form. If it was less than half a year (183 days), you cannot claim the EITC for that child.

Line 8 – If your qualifying child was born or died during the tax year on line 1, enter the date here. Otherwise, you can skip this question.

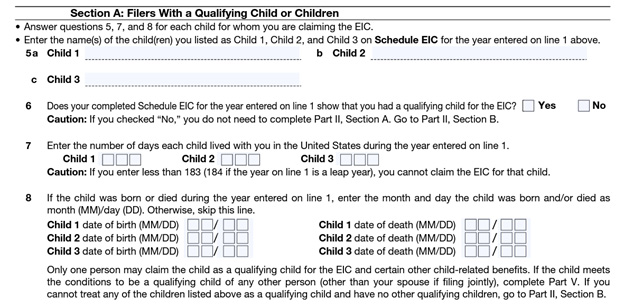

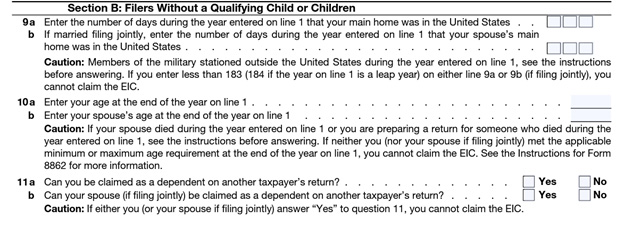

Section B

If you do not have a qualifying child, complete this section.

Line 9 – For 9a, enter the number of days that your main home was in the U.S. during the tax year in question. If you are married and filing jointly, enter the number of days for your spouse on 9b. If either line is less than 183 days, you cannot claim the EITC. There are, however, special rules for military personnel stationed outside the country.

Line 10 – Enter your age at the end of the tax year on line 10a. If married, enter your spouse’s age on 10b.

Line 11 – If either you or your spouse can be claimed as a dependent on another taxpayer’s return, check “yes” on the appropriate line (a or b) and stop. You are not eligible to take the EITC. If you checked “no,” you can continue with the form (if claiming other credits) or include the completed Form 8862 with your tax return. If your qualifying child can be claimed as a qualifying child by another taxpayer (other than your spouse if filing jointly), you must also complete Part V.

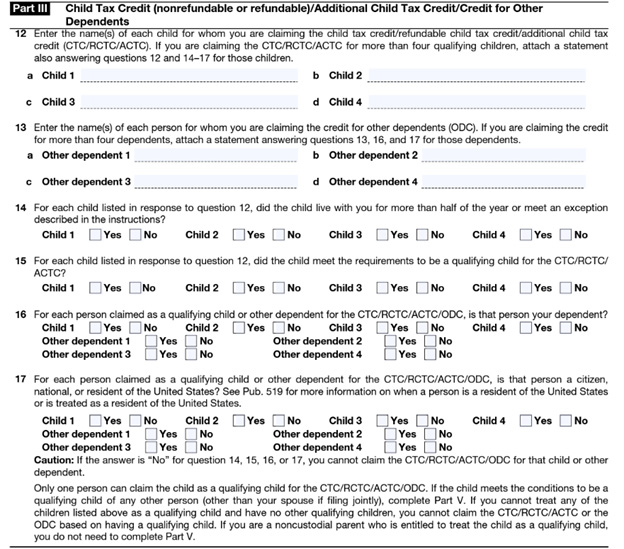

Part III – Child Tax Credit/Additional Child Tax Credit/Credit for Other Dependents

Complete Part III if you are claiming the Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), or Credit for Other Dependents (ODC).

Line 12 – Enter the name(s) of the child(ren) for whom you are claiming the CTC (refundable or non-refundable) or ACTC. If you have more than four qualifying children, attach a statement with the responses to lines 12 and 14 through 17 for those children.

Line 13 – Enter the names of each person you are claiming the ODC. If you have more than four, attach a statement answering lines 13, 16, and 17 for those dependents.

Line 14 – For each child listed on line 12, indicate whether they have lived with you for at least half of the tax year. Temporary absences, such as school, medical treatment, or imprisonment count as time lived with you. There are also exceptions for kidnapped children or children of divorced/separated parents.

Line 15 – Indicate whether the child(ren) listed on line 12 meets the requirements for a qualifying child for the CTC or ACTC. A qualifying child is a child who meets the following:

- Is your son or daughter (natural, step, foster, or adopted), sibling (full, half, or step), or a descendant of any of them (for example, your grandchild, niece, or nephew);

- Was 16 or younger at the end of the tax year;

- Did not provide over half of their own support for the year;

- Lived with you for more than half of the year;

- Is claimed as a dependent on your return;

- Does not file a joint return for the year (or files it only to claim a refund of withheld income tax or estimated tax paid); and

- Was a U.S. citizen, a U.S. national, or a U.S. resident alien.

Line 16 – Indicate whether the qualifying child or other dependent is also your dependent.

Line 17 – Answer “yes” or “no” for each child regarding U.S. citizenship.

If you answered “no” for any person on lines 14, 15, 16, or 17, you cannot claim the CTC, ACTC, or ODC for that child or other dependent.

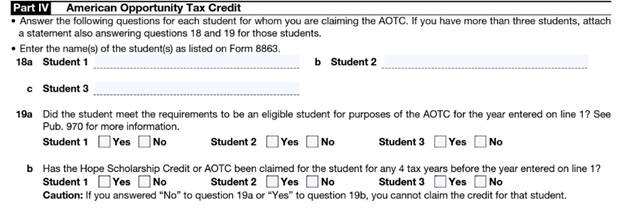

Part IV – American Opportunity Tax Credit (AOTC)

Complete Part IV if you are claiming the AOTC.

Line 18 – Enter the name(s) of the student(s) listed on Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits). If you have more than three students, attach an additional statement including lines 18 and 19 for those students.

Line 19 – Indicate whether the student(s) meets the requirements for an eligible student under AOTC guidelines (see Publication 970 for more information) on line 19a. For line 19b, mark “no” if the student has not been claimed for the Hope Scholarship Credit or AOTC in the previous four tax years. If you check “yes” to 19b or “no” to 19a, you cannot claim the AOTC.

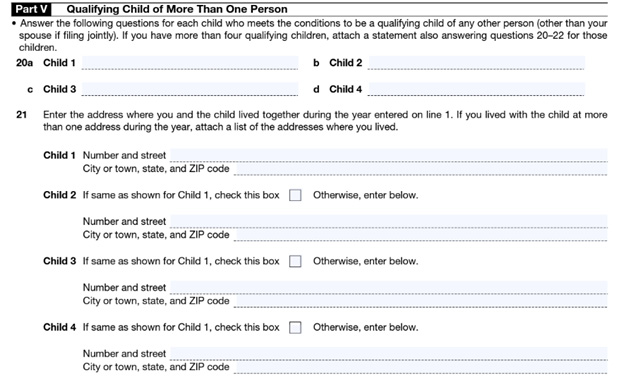

Part V – Qualifying Child of More Than One Person

If another person (other than your spouse if filing jointly) can claim your qualifying child as their own, you must complete Part V of Form 8862.

Line 20 – List the names of any child who meets the conditions of a qualifying child for another taxpayer. If there are more than four, attach a statement also answering lines 20 through 22 for those children.

Line 21 – Enter the address where you and your child(ren) lived together during the tax year. If you lived in more than one place, attach a list of addresses where you lived.

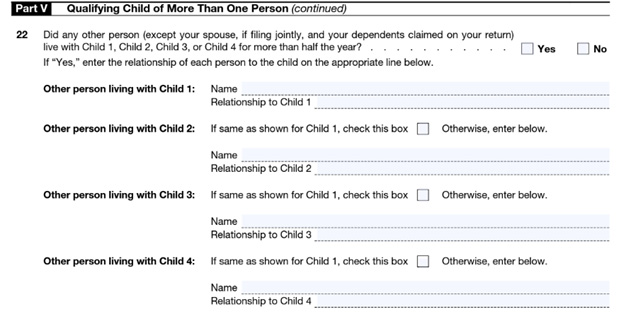

Line 22 – If any other person (excluding your spouse and dependents claimed on your tax return) lived with your child(ren) for more than half of the year, check “yes” and enter that person’s name and relationship to the child. If no one else lived with your child for more than half of the tax year, check the “no” box.

You can include IRS Form 8862 when filing your tax return electronically. If the IRS sent you a notice requesting that you complete the form, mail it to the address provided in the letter. Please note that a signature is not required on the completed form.

Need Help?

If you need help completing IRS Form 8862, please refer to the form instructions or contact Tax Defense Network at 855-476-6920. We offer affordable tax preparation services for individuals and small business owners.