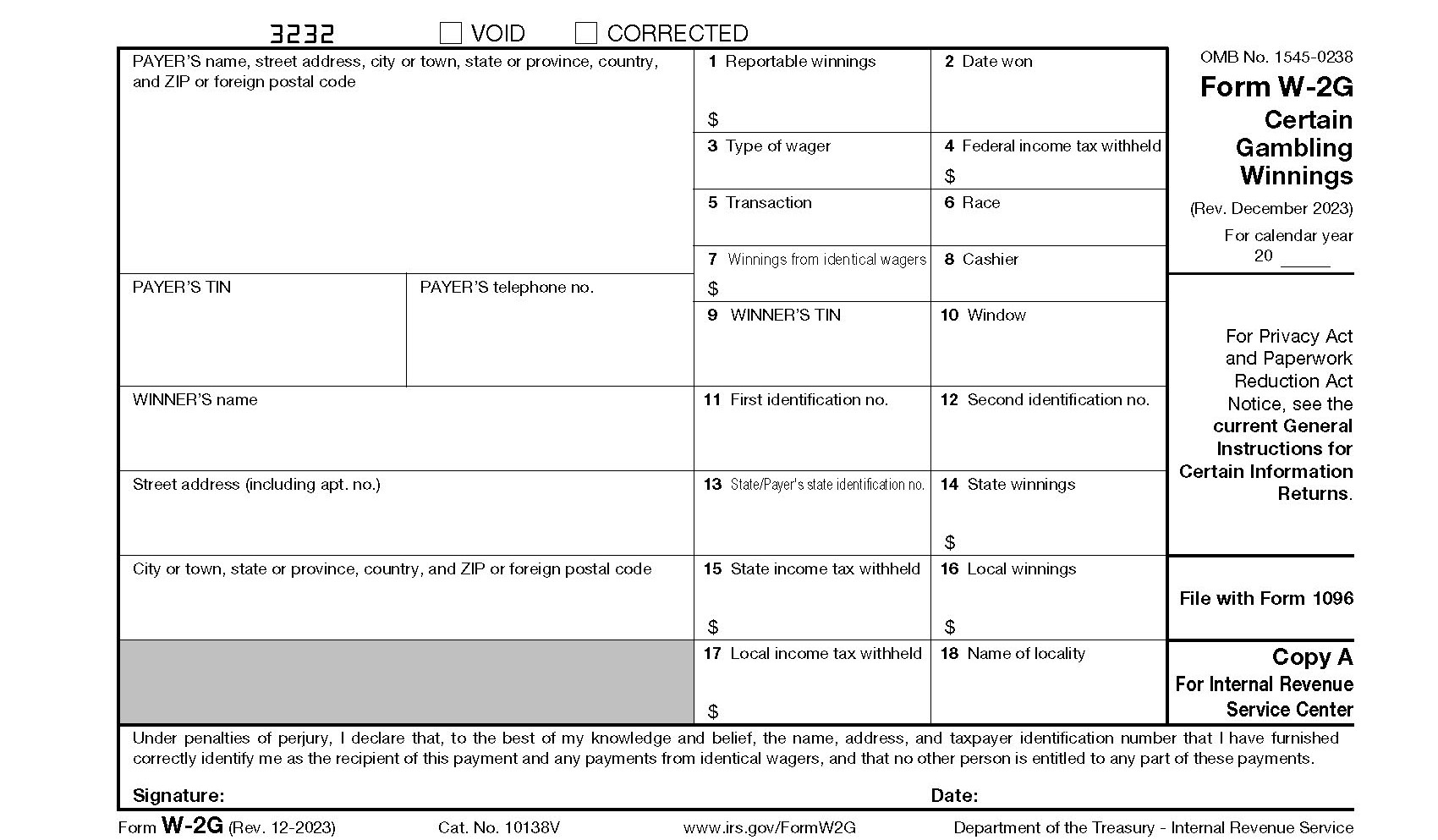

Form W-2G, Certain Gambling Winnings

Do you play poker, bet on horses, or frequent casinos? There’s a chance that you may receive Form W-2G. This IRS form contains information regarding your gambling winnings for the prior year and must be reported when filing your taxes.

When is a Form W-2G Issued?

You are required by law to report all winnings from any gambling activity, regardless of how much you earned. This includes lottery tickets, slots, card games, sports betting, and even those friendly bingo games at the local senior center. It also includes any money you may have won outside the United States.

Gaming facilities are required to furnish Form W-2G if your gambling winnings exceed any of these limits:

- $1200 or more from a bingo game or slot machine;

- $1,500 or more from a keno game;

- $5,000 or more from a poker tournament;

- $600 or more from other betting (if the win is at least 300 times the wager)

If you don’t receive a W2-G from a facility, you are still required to report your winnings on your tax return. Failure to do so could result in you receiving IRS Notice CP 2000. If you owe additional taxes as a result of underreporting your income, you’ll be charged interest on the unpaid balance until it is paid in full.

W-2G For Withholding

You may also receive Form W-2G if the gaming facility withheld part of your winnings for federal taxes. There are two types of withholding:

- Backup withholding. If you fail to provide your Social Security number at the time you received the money, you could be subject to 28% backup withholding. Payments for bingo, keno, slots, and poker tournaments are also subject to the higher backup holding rate.

- Regular withholding. For cash prizes over $5,000 (minus the wager), a 25% regular withholding fee may apply. This may jump to 33.33% for various non-cash winnings earned through sweepstakes, wagering pools, and certain lotteries.

If any taxes were withheld from your winnings, they will be reported in box 4 of your W-2G. Depending on your tax bracket, you may owe additional taxes over what was taken, or be due a refund.

W-2G Example

Can You Claim Gambling Losses?

Taxpayers who claim the standard deduction cannot claim gambling losses on their tax returns. To offset your winnings and lower your tax liability by claiming your losses, you would need to itemize your deductions on Schedule A. Losses, however, cannot exceed your total winnings. Other expenses incurred while gambling, such as travel or lodging costs, are not deductible.

If you plan to offset your winnings with your losses, you’ll need to keep good records. This includes win/loss statements, receipts, bank statements, credit records, tickets (lottery, dog track, etc.), and any other supporting documents. Gambling logs that contain the date and type of wager, address of the location, the amount won or lost, as well as names of others present are also acceptable proof for gambling losses and/or wins.

When the standard deduction increased in 2018, most taxpayers stopped itemizing deductions. Depending on your specific situation, however, it may be worth your time to itemize if it significantly reduces your tax liability.

Need Help With Your Taxes?

Facing an unexpected tax bill due to gambling winnings? Don’t panic. Contact Tax Defense Network at 855-476-6920 for a free consultation. We offer tax prep services and can help you get into an affordable payment plan with the IRS, if needed.